One of the great investing books of the last 40 years was David Dreman’s, Contrarian Investment Strategy. He started it by telling of a hypothetical gaming casino with two separate, but adjoining, rooms: the red room and the green room. The red room was packed with people and excitement and almost every day someone hit a huge jackpot setting the building on fire with electricity. Every seat was packed, others waited their turn to play and the anticipation was palpable. Yet most of the players left the casino each night without their money, because the odds were stacked heavily in the house’s favor.

The green room was relatively quiet and included many empty seats. Players sat patiently and most of them had amassed large chip stacks. Virtually nobody hit it big each day, but with through patience and odds stacked heavily in their favor most the participants in the green room created wealth.

In the last 20 years, we think a new room should be added to Dreman’s imaginary casino. We call it the “beige” room. This room is filled with investors who had the natural reaction to bad experiences in the red room, but lacked the patience to succeed in the green room. In this room you will find participants in passive indexes. Additionally, we think stock market difficulties since 2000 triggered former green room participants to lose their patience, thus contributing to the popularity of being average.

Dreman was trying to explain the difference between investing in common stocks based on excitement about future prospects versus buying stocks based on value or intrinsic value. This has been over simplified by using monikers such as growth stock and value stock. For the sake of our discussion, let’s say that a value stock is one priced below the average stock and a growth stock is one priced above the average. The most common averages used are the price-to-earnings ratio (P/E) and the price-to-book ratio (P/B).

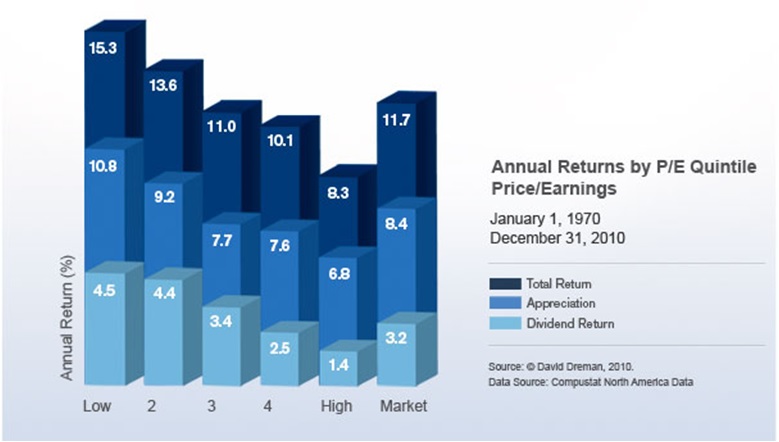

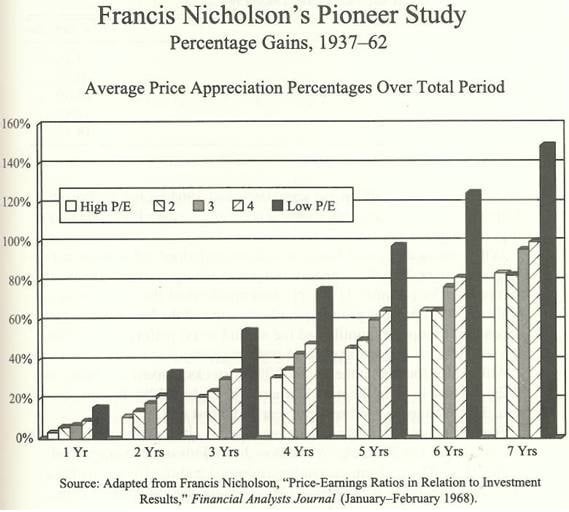

Every academic study we’ve seen shows that over one, three, five and seven-year time periods the cheapest stocks outperform the average and most expensive stocks. The most famous of these studies are the ones in Dreman’s book (see below), Fama and French’s P/B study and Francis Nicholson’s study from 1937-1962.

Dreman used P/E quintiles, while Fama and French used P/B ratios and both studies rebalanced at the end of each year. They argued that excess return could be had by simply starting the year with the cheapest stocks in the S&P 500 Index and replacing the ones which found favor during the year with the latest ones to find the doghouse. These studies led to the “Dog’s of the Dow” strategy, where an investor purchases the 10 cheapest stocks in the index based on dividend yield (another measurement of cheapness).

We found Nicholson’s study (see below) even more fascinating because his portfolio was static. It showed that cheap stocks at the beginning not only outperform in the next 12 months, but that their outperformance continues on for seven years. We like to say that cheap stocks are the gifts which keep on giving.

Warren Buffett, the number one disciple of the father of value investing, Benjamin Graham, started out being a green room common stock investor and continues to do so in the private equity realm as well. In the 1960’s, he ran into his investing partner, Charlie Munger. Mr. Munger advocated for a qualitative addition to these quantitative strategies. He and Buffett believe that the long duration investor, with great patience, can benefit from owning very high quality businesses purchased at a time of distress. They believe that the primary responsibility of the wise long duration investor is to wait until a splendid business gets in the doghouse due to a bear market in stocks or a temporary corporate stumble. Then they pounce on that opportunity by “backing up the truck” and loading up on shares.

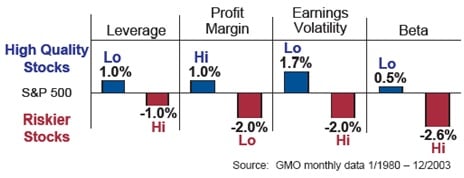

Munger’s theory was proven correct in a seminal study done by Ben Inker at Grantham, Mayo and Van Otterloo (see below). His study showed that certain qualitative characteristics like low leverage, high and sustainable profitability, low earnings volatility and low volatility in stock trading have proven to add alpha over long durations.

We at Smead Capital Management start our research by leaning toward Dreman’s study, because “valuation matters dearly.” We love Nicholson’s study because the seven-year holding period shows that you can own businesses for a long time and keep your portfolio turnover down. Turnover is a huge annual tax on large-cap equity portfolios and the cost averages 81 basis points or 0.81% annually among large-cap U.S. equity funds.

However, we at Smead Capital are risk averse and recognize that human nature gets in the way of holding businesses for a long time, especially in the low-quality arena. This is where Munger and Inker, with their focus on high-quality, come into play and how we seek to reduce portfolio risk proactively.

In late 2008, after getting clobbered all year, we received many calls to the effect of “Bill, we know you want to own stocks for a long time and we believe in what you are doing. But shouldn’t we get out of the way of this decline in case we have a total economic meltdown like in the 1930s?”

Our answer was simple. The only “safe” alternative was investing in Treasury bills/bonds or government-insured certificates of deposit. We pointed out that the merit of those “safe” investments was the backing of the U.S. government. Our government’s guarantee is no better than its ability to collect income taxes. Those taxes are paid by the largest companies in the U.S. and their employees. Therefore, the safety of Certificates of Deposits and T-bonds came from the safety provided by the qualitative characteristics of the stocks in our portfolio. Selling quality stocks at a time of distress was an especially bad idea, in our opinion.

What does the red room look like today? It is filled with investors seeking above-average returns by paying extremely high P/E and P/B ratios for companies with perceived “bright” futures in an attempt to hit the jackpot. Red room regulars are excited about social media, internet-based information/advertising, online shopping, fast food, cloud computing and the “sharing” economy. It is enough to make you want to open a bureau in Silicon Valley.

What is going on in the beige room lately? The beige room (index investing) has a tendency to work great in an uninterrupted bull market like the one we enjoyed from March of 2009 to the peak in the summer of 2015. There is historical evidence of the index becoming overloaded with shares of the previous era’s most successful companies, ala tech stocks in 1999. In effect, valuation works against the index when it has been particularly effective in the prior five to ten years.

The S&P 500 Index has enjoyed the tailwinds of its overweight position in multi-national companies, who drafted on emerging market growth in staple products, heavy industrial infrastructure investments in China and technology purchases everywhere. Since we are of the opinion that the U.S. economy will do better in the next ten years as compared to the last ten years, we contend that the index is at a disadvantage because nearly half of its revenue comes from abroad.

Lastly, there are some pretty persuasive arguments which surround the idea that index returns will be in the 6% area going forward. These theories take into account dividends that are lower than historical averages and interest rate increases over time which would reduce historically high profit margins. Our opinion is that the beige room is appropriate for those who are incapable of investing in the green room or unable to figure out whom is. Owning U.S. large-cap equity for a long time is preferable to most other liquid investments and you can get average performance from an attractive asset class in the beige room.

Where are folks congregating in the green room? They are rummaging around in financial service companies like banks and insurance, which have low P/E and P/B ratios. The death of traditional media and advertising is a foregone investor conclusion and the lowest P/E and P/B ratios lists are sprinkled with TV content and broadcasting companies, network-affiliate station owners and newspaper/magazine publishers. We are always on the lookout for companies on the cheapest list which meet our eight criteria for stock selection because valuation matters dearly, we want to own companies for a long time and to do that we must own very high quality companies. Thank you for your ongoing confidence in our methodology.

The information contained in this newsletter represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Newsletter and others are available at smeadcap.com