Dear fellow investors,

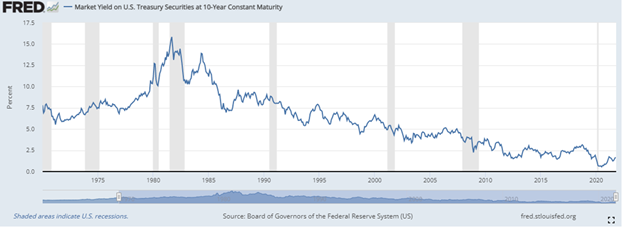

During our quarterly webcast last week (October 21, 2021), someone asked us a great question. They asked, “Does the ten-year Treasury bond rate at 1.65% and an inflation rate of 5% teach us that inflation will be transitory?” It is an important question because the majority of economists and market strategists are betting that inflation is transitory. Look at the chart of 10-Year Treasury bonds going back to 1970:

Our answer to the question goes back to 1981, when we were at the other extreme. Interest rates had been rising for years and inflation was running at 11%. When the 10-Year bond peaked at 15% in 1981 with an inflation rate of 11%, did that tell you anything about where interest rates were going? In effect, did the big spread of interest rates over inflation tell you that rates were headed higher (like most economists and market strategists thought in 1981)?

The answer to that question effectively answers today’s question. The 10-Year Treasury bond rate fell from 15% to 11% by early 1983, because the psychological bearishness and the big spread investors were demanding of a 4% interest rate cushion laid the groundwork for a huge contrarian move in prices. By 1984, inflation had dropped to 4%, even though the economy was booming on the back of 79 million baby boomers buying houses and cars. They gave bond buyers a lifetime gift in 1984 by allowing us to buy 14% bonds with a trailing inflation rate of 4%.

This brings us to today, when bond investors are being compensated at interest rates which temporarily provide negative real returns. Those negative real returns will exist until inflation drops below the current bond interest rate. History would argue that the overconfidence investors have in bonds, and in the Federal Reserve Board’s ability to handle what we call the “inflation wolverine,” tells you that we could be at the opposite extreme of 1981.

Therefore, based on history, what could happen as the bond market adjusts to much higher permanent rates of inflation as 90 million millennials replace 65 million GenXers in the key 30–45-year-old age bracket dominated by house and car purchases? Where will interest rates go and how will that affect the stock market that is overweighted in technology and multi-billion-dollar growth stocks? Which stock sectors can make money in a much more difficult stock market dealing with much higher interest rates and strong economic growth?

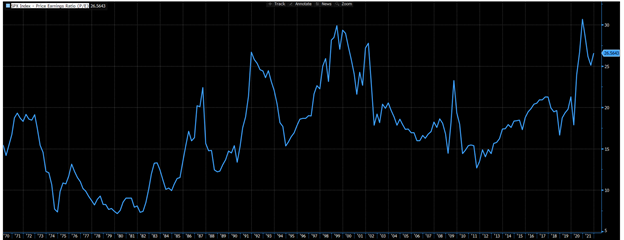

First, if inflation is sustained at around 5%, the 10-Year Treasury bond must gravitate to a rate that gives a “real” return for investors by going as high as 6%. This would crush bond investments and probably crush the price-to-earnings (P/E) and the price-to-sales ratios of common stocks. To many investors who have come to the party in the last five years, this could unleash living hell on their portfolios. Ironically, it would probably take P/E ratios to historical norms at best and below those norms at worst. See the P/E ratio distribution since 1970:

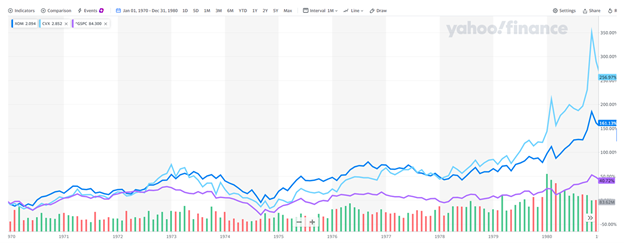

Second, the law of fashion would gravitate from innovation/tech stocks to companies and sectors which benefit directly from roaring commodity prices and inflationary repricing. To us this seems to argue for oil and gas land, residential land and suburban land. Oil looks like the point-person commodity for overall commodities and the land owned by the oil and gas companies with proven reserves in the ground look incredibly attractive going forward. We own Continental Resources (CLR), ConocoPhillips (COP), Occidental Petroleum (OXY) and Chevron (CVX), in that sector. As Mae West used to say, “Too much of a good thing can be wonderful.” Look how Exxon (XOM) and Chevron did in the inflationary 1970s relative to the S&P 500 Index:

On the other hand, we believe the movement all over the country by millennials to buy houses in more affordable areas will cause home building to flourish despite higher interest rates. This is because owning your own home is one of the ways that the average American household can insulate itself from inflation. This makes Lennar (LEN) and D.R. Horton (DHI) appear very attractive. As folks buy houses away from big city cores, suburban shopping/restaurant/entertainment venues (aka Class A malls) will sit on land which goes up in value while rents rise at the higher inflation rates. Macerich (MAC) looks especially undervalued on that basis as the owner of some of the best Class A malls in America.

To tie all this together, let’s be reminded that most investors will suffer stock market failure. If you believe that buying bonds at 1.65% when inflation is running at 5% and owning the S&P 500 Index loaded with growth stocks in a potentially rising interest rate environment is a good idea, we would suggest a review of your strategy.

Warm regards,

William Smead

The information contained in this missive represents Smead Capital Management\’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2021 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com.