Dear fellow investors,

We consider ourselves excellent spectators of competition and look forward to March Madness this month. We are reminded that these very competitive games can’t take place unless there are rules and referees to officiate. Our long-time readers are aware that we have warned of the danger surrounding the aggregation of power by the monopolistic tech behemoths. In the last week, March 11-17, 2019, everyone from Senator Elizabeth Warren to The Wall Street Journal editorialist, Andy Kessler, to Arizona State Attorney General, Mark Brnovich, have weighed in on the subject of the rules surrounding competition in business and who should be officiating. We would like to reexplain our position on this subject, because we believe it is a most critical question in U.S. long-term economic success, in economic inequality and in where to invest in the U.S. stock market.

We were surprised that Senator Elizabeth Warren has come the closest to our perception of the problem.1

“Today’s big tech companies have too much power—too much power over our economy, our society and our democracy,” Ms. Warren said in an online post. “They’ve bulldozed competition, used our private information for profit and tilted the playing field against everyone else. And in the process, they have hurt small businesses and stifled innovation.”

The article continues:

“Ms. Warren’s position, like others she has taken, places her on the left wing of the Democratic field and escalates comments she has made in recent years. She has repeatedly criticized U.S. antitrust enforcement as inadequate, under both Democratic and Republican leadership, at the two agencies tasked with protecting competition: the U.S. Department of Justice and the Federal Trade Commission.”

Do you have a sturdy chair? We agree with Mrs. Warren on this subject and sense that she and her staff have been working with Lina Khan, who has done the best writing and has been making the best arguments tied to rewriting our antitrust laws to include the ability to aggregate monopoly power via the internet. Normally, the existing rules and the existing referees could handle this job.

Next, Andy Kessler, in an op-Ed titled “Warren’s Populist Puritanism” and Mark Brnovich, Arizona State Attorney General, came along. Kessler appears to be shilling for the tech behemoths, because he’s probably been made wealthy via his own tech venture investments. Second, he is making a tired argument that is based on the old antitrust laws, not the updated ones which Ms. Khan and Mrs. Warren are arguing for. Here is an excerpt from Kessler’s opinion piece in The Wall Street Journal:2

“Yet the Sherman Antitrust Act prohibits two specific types of business practices: anticompetitive agreements, or collusion, and conduct to limit competition. Judges define these violations by a consumer-welfare standard, assessing whether consumers are harmed by a lack of competition. “Innocent monopolies” earned by merit are not illegal. Antitrust says nothing about bigness.”

Kessler makes it look like he’s working for Facebook, Amazon and Google by attacking Elizabeth Warren as a “populist puritan.” You might guess that those of us who pick stocks for a living don’t agree with many of Senator Warren’s anti-business proposals. However, prior socialist-oriented proposals don’t really have anything to do with the merits of creating updated antitrust laws “internet style.”

Kessler made the worn-out argument which says, under the existing antitrust laws, that consumers benefit from free social media, free search and free delivery (this is why we call them “Three Identical Strangers”). Kessler forgets that American consumers are very much like a frog in a pot of water which was recently turned on high. By the time it is boiling, there will be no remedy. Without a rewrite of the rules and attention from well-qualified referees, these companies will have crushed any and all competition.

Brnovich correctly points out that Washington politicians (especially Republicans who should understand Teddy Roosevelt’s trust-busting activities in the early 1900s) have been asleep at the wheel on this subject and might not ever get anything done. Therefore, he said it is up to the state attorney generals to step up and force the Federal government to get to work. Ironically, former Missouri Attorney General and now U.S. Senator, Josh Hawley, was making this argument loudly as a candidate for his now-won Senate seat. We’d love to hear from him!

- Monopoly power has been easier to aggregate on the internet and is a huge threat to our economy. There are limits to how much success can go to too few people, before it destroys Democratic Capitalism. John D. Rockefeller wanted to own every oil well, oil refinery and gas station in the U.S. (can you see Jeff Bezos in this?). Teddy Roosevelt figured this out before it ruined the economy in the early 1900s. There were only 4,000 cars sold in the U.S. in 1900. Roosevelt broke up Standard Oil into nine companies by the time we had sold 3.5 million automobiles in 1925. What kind of economic success would we have had if one guy and his company had complete control over the price of gasoline?

- Economic inequality has exploded because a legendary part of the wealth in our society has been transferred from the businesses who have not aggregated power via the internet to three which have. One word from Amazon that they are coming into another business crushes stocks in affected industries. Scott Galloway, from NYU Business School, explains that when someone announces going into healthcare or groceries or entertainment, billions of dollars of stock market capitalization can be stripped off of the net worth of every shareholder from mom-and-pop to endowments and pension plans. Galloway would argue that it is too much power. Why should we think that outdated antitrust laws written between 1900-1920 should give the rules which cover commerce on an internet which Katie Couric couldn’t understand in 1995?3 The competition needs new rules and better officiating.

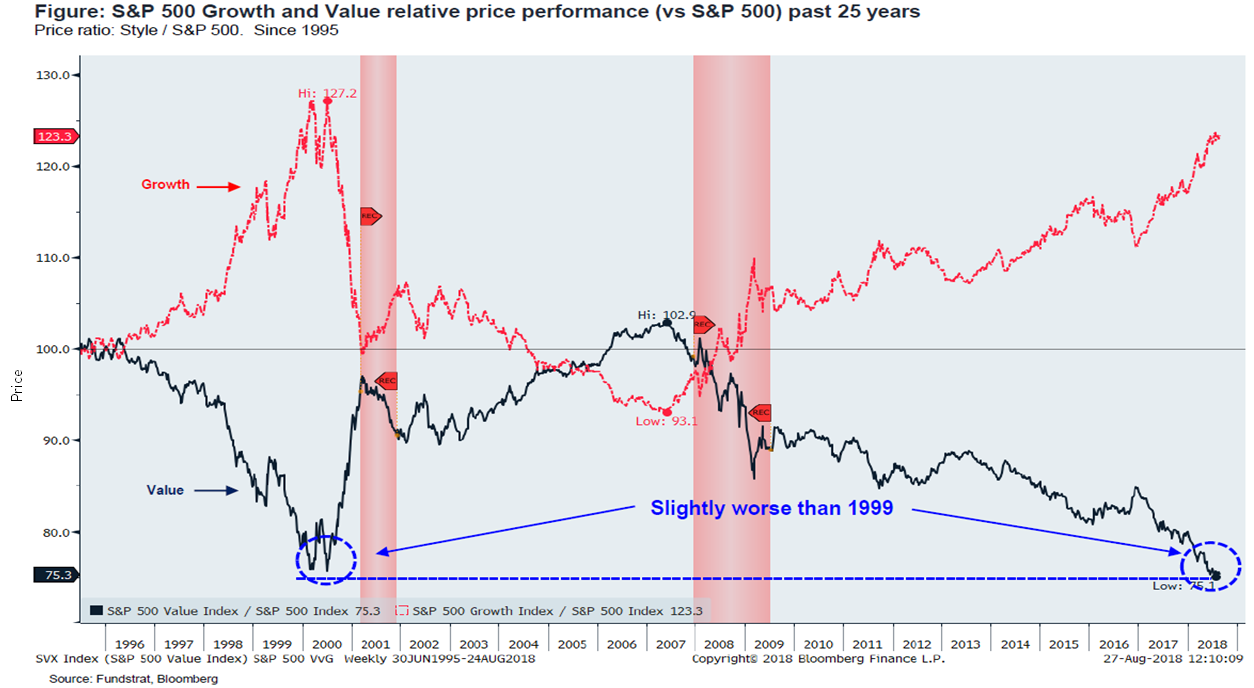

- These monopolistic tech behemoths have been allowed to grow power unchecked, because we haven’t been rewriting the antitrust laws “internet style.” Investors have flocked to the common shares of Facebook, Google and Amazon and ditched anyone who dared step into their path. Look at how growth stock investing has dominated value investing in the last ten years as investors chased these monopolists.

Source: Fundstrat.Does one company having 95% market share in social media help anyone in society? Does getting 80% of the internet advertising in the U.S. and tracking everything thing you do via search cause your average neighborhood to prosper? Does getting a bargain on free delivery from Amazon, subsidized by web hosting the pornography industry, really head us in the direction which will make capitalism thrive in a democracy?

We have no way of knowing when these new rules will be considered or adopted, though the stock market is an anticipatory vehicle. The popularity of these companies could continue for some time, but we believe investors would be wise to sift through the ashes of the companies burned by having the wrong rules and the “look the other way” officiating. In the 1980 book The Money Masters by John Train, Warren Buffett laid out his stock picking criteria. Number four on his list was beware of a company about to get regulated. Thanks to Senator Warren and Arizona Attorney General Brnovich, the “Three Identical Strangers” better prepare for antitrust laws “internet style.” In the meantime, we will look for contrary bargains in the industries most affected by their monopoly dreams, like healthcare, media, retailing and whatever they decide to go into next.

Warm regards,

William Smead

1Source: The Wall Street Journal

2Source: The Wall Street Journal

3Source: YouTube

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO and CEO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2019 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com.