Dear fellow investors,

In studies, 90% of drivers think they are above average. We believe that 100% of the people who pick stocks for a living think they will be above average. Is being above average a worthy goal and is the generation of alpha or excess return something to strive for?

Alpha is defined as:

“Alpha is used in finance as a measure of performance, indicating when a strategy, trader, or portfolio manager has managed to beat the market return or other benchmark over some period. Alpha, often considered the active return on an investment, gauges the performance of an investment against a market index or benchmark that is considered to represent the market’s movement as a whole.”

We are the managers of a concentrated 25-30 stock portfolio purchased based on our eight criteria for common stock selection. What are the demonstrable sources of alpha to all stock picking organizations? Where does alpha come from in our discipline? What are the opportunities currently in the marketplace for alpha?

We believe there are four sources of alpha in stock picking. They are valuation, stock selection, low turnover and courage/contrarianism.

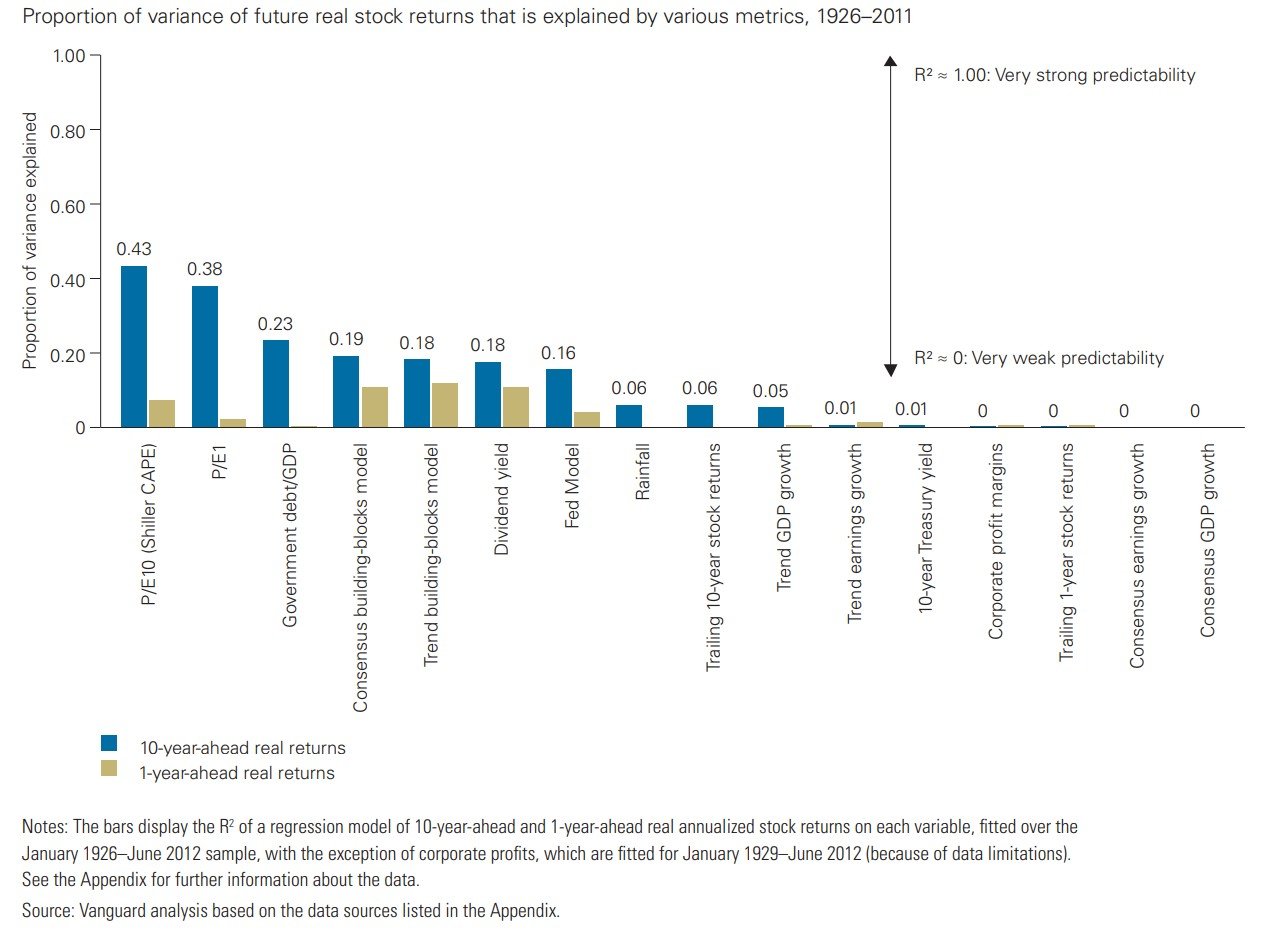

Let’s start with valuation. We have always said that valuation matters dearly. We look to buy shares in a company that we would feel good about if the stock market didn’t open for five years. Would you like to be the receiver of the profits of the company as a private company?

Second, we have eight criteria for stock selection which are designed to allow us to buy into meritorious companies at a time that there is a reason for them to be doubted by most investors. Our eight criteria are listed below:

Required over entire holding period:

- Meets an economic need

- Strong competitive advantage (wide moats or barriers to entry)

- Long history of profitability and strong operating metrics

- Generates high levels of free cash flow

- Available at a low price in relation to intrinsic value

Favored, but not required:

- Management’s history of shareholder friendliness

- Strong balance sheet

- Strong insider ownership (preferably with recent purchases)

Every company we own must satisfy the required criteria. For companies that do not also meet the favored criteria, we believe these short-term conditions will be ultimately corrected or overwhelmed by the required criteria.

Most of these criteria speak to having a margin of safety in our purchases. If a turnaround is needed, does the company have the financial strength to turn things around? Did American Express have the financial strength to survive losing 10% of their credit card holders when they divorced Costco (COST)? Did Target (TGT) have the financial strength to come back from the failure to succeed in Canada, fight off Amazon and recover from offending many of their best customers last year? To us the answer is yes.

Do companies have brand attachment? Moat is one of the most difficult criteria for most investors to understand. Measuring it is an art rather than math or science and we believe our 43 years of participation in the stock market gives us an advantage on understanding moats. We are weird folks because we never forget a meritorious company that we were admiring and not owning from the outside looking in.

Low turnover requires patience and carries a big reward. The biggest part of alpha comes from long-term winners that you sat with through numerous corrections in the process. We will give you a simple example: if you buy a stock at $30 per share and pay cash, you are limited to losing $30 per share. If you buy a stock at $30 per share that goes to $90 and sell it, you will leave $120 on the table if it goes to $210. What is worse, losing $30 per share or the sin of omission by missing the next $120 gain per share?

Our final factor is courage/contrarianism. Sir John Templeton said, “If you can see the light at the end of the tunnel, you are too late!” Our optimism for companies goes up as the price goes down when it fits our eight criteria for stock selection. Most of the time our rewards take 12-18 months to show up and, in some cases, have taken longer. Therefore, courage combined with patience at the point of purchase and ownership combined with patience on winners has been a source of alpha for us.

Where are we driving our portfolio now? We are holding cheap winners in oil and gas like Occidental Petroleum (OXY) and ConocoPhillips (COP), as well as cheap multi-year winners in home building like D.R. Horton (DHI) and Lennar (LEN). We are buying new positions in depressed regional banks and adding to undervalued oil and gas stocks which replaced Continental Resources after it got bought out. We are holding long-term winners that look very reasonable in Merck (MRK), Amgen (AMGN) and Bank of America (BAC).

As opposed to drivers who overestimate themselves, we seek to be above-average stock pickers by doing the things that most professional investors struggle with, like being courageous and patient. We hope to help our investors to avoid stock market failure in the process.

Warm Regards,

William Smead

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2024 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com