Dear fellow investors,

Close your eyes and imagine the elimination of gasoline-powered automobiles. Among people who believe in a quick transition away from gasoline to electric vehicles, they conveniently overlook the second-order effects, one of which is what might happen to the price of electricity with such an increase in demand. Is there a magician out there who can create the electricity needed to replace the gasoline we use today? Let’s sit in on a good first-year economics class to see how supply and demand are adding up.

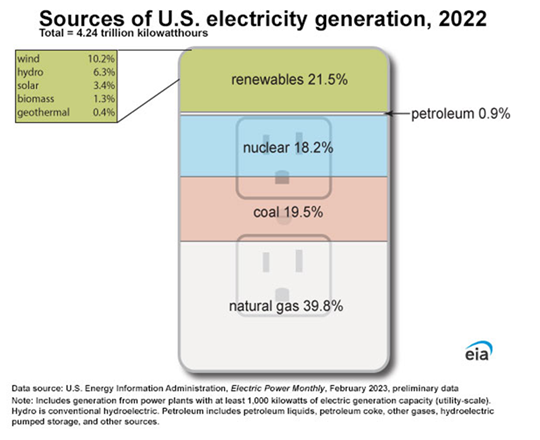

Among renewables, wind and solar made up 13.6% of electricity generation last year. Massive tax incentives are in place and could lead to a near doubling of this category to 25% of electricity in ten years. Hydroelectricity is in no position to grow as we aren’t making new rivers. Biomass and geothermal could grow off a tiny base but appear to have no chance of being a major supply solution.

Nuclear is 18% and is in no position to grow and could decline. Coal-fired production declined 40% in the last ten years and only an optimist would hope for less than a 40% decline in the next ten years.

EIA estimates a 40-50% decline in coal-fired generation:

Refined oil is a tiny source of supply and unattractive to the body politic. Natural gas has languished in price in recent years but is an abundant byproduct of oil and gas exploration and production. However, the body politic is dissuading oil and gas companies from drilling for oil and automatically finding fewer new supplies of natural gas. The use of natural gas to make electricity could grow quite a bit, especially if our inner Boone Pickens gets channeled.

On the demand side, the Brookings Institute estimates that electricity demand will rise 25% by 2030. This figure could be conservative if electric vehicle adoption picks up. Therefore, we will pick a conservative number and assume a 35% increase in electricity demand in the U.S. over the next ten years.

Putting the ten-year supply and demand dynamics together looks to us like this:

- Renewable supply up 15%.

- Coal-fired plant supply down a minimum of 10%.

- Optimistic flat supply for other sources.

- In total, an estimated 5% increase in supply over ten years.

- A 5% increase in supply and a 35% increase in demand could produce dramatically higher electricity prices.

Here is what electricity prices have done over seven years in California, the state attempting the fastest transition away from fossil fuels:

These supply and demand dynamics argue for electricity inflation and/or a boom in natural gas prices or production. Since most natural gas is found by drilling for oil, a big production expansion is unlikely.

Look at the chart below and ask yourself where natural gas prices and electricity will be when everyone is dependent on them.

Also, remember that there is an incredible enthusiasm for renewable clean energy forms which might or might not develop to meet this demand. It looks like some magic is required for things to end well despite massive government subsidies. For this reason, fear stock market failure!

Warm regards,

William Smead

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2023 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com