Dear fellow investors,

Watching Warren Buffett and Charlie Munger Saturday in Omaha caused us to think about a very popular 1960s TV show called, “The Dating Game.” Hosted by Jim Lange, the game was played with the host on one side of a wall with a male or female contestant. On the other side were three people of the opposite sex and they were attempting to answer questions and get a date. The political pressure against oil drilling and exploration makes “dating” look very attractive to us in the oil industry!

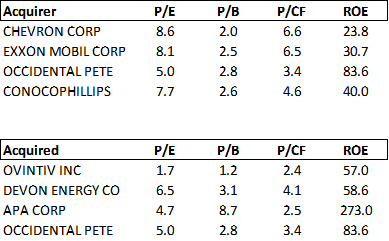

Warren Buffett made clear he’s not going to buy Occidental Petroleum (OXY), but we believe it wouldn’t break his heart if one of the other contestants bought his huge stake in OXY. He raved about the company, and you can tell how much he likes their CEO, Vicky Hollub. So here is our list of contestants in the oil consolidation dating game and a list of potential acquisition candidates.

Notice how incredibly undervalued the lower list of companies are in relation to the possible acquirers! In a world that condemns you for drilling for oil and gas, why not buy long-lived production streams that have the holes poked in the ground already?

Charlie Munger knows the oil business better than Warren. He and Warren explained that Charlie gets $840,000 per year in royalties from a long-life well in California. His original investment was $1,000. Charlie mentioned that he is not so sure if global warming even exists, and he is very familiar with arguments from both sides as a Harvard Law grad and a Cal Tech student at one point.

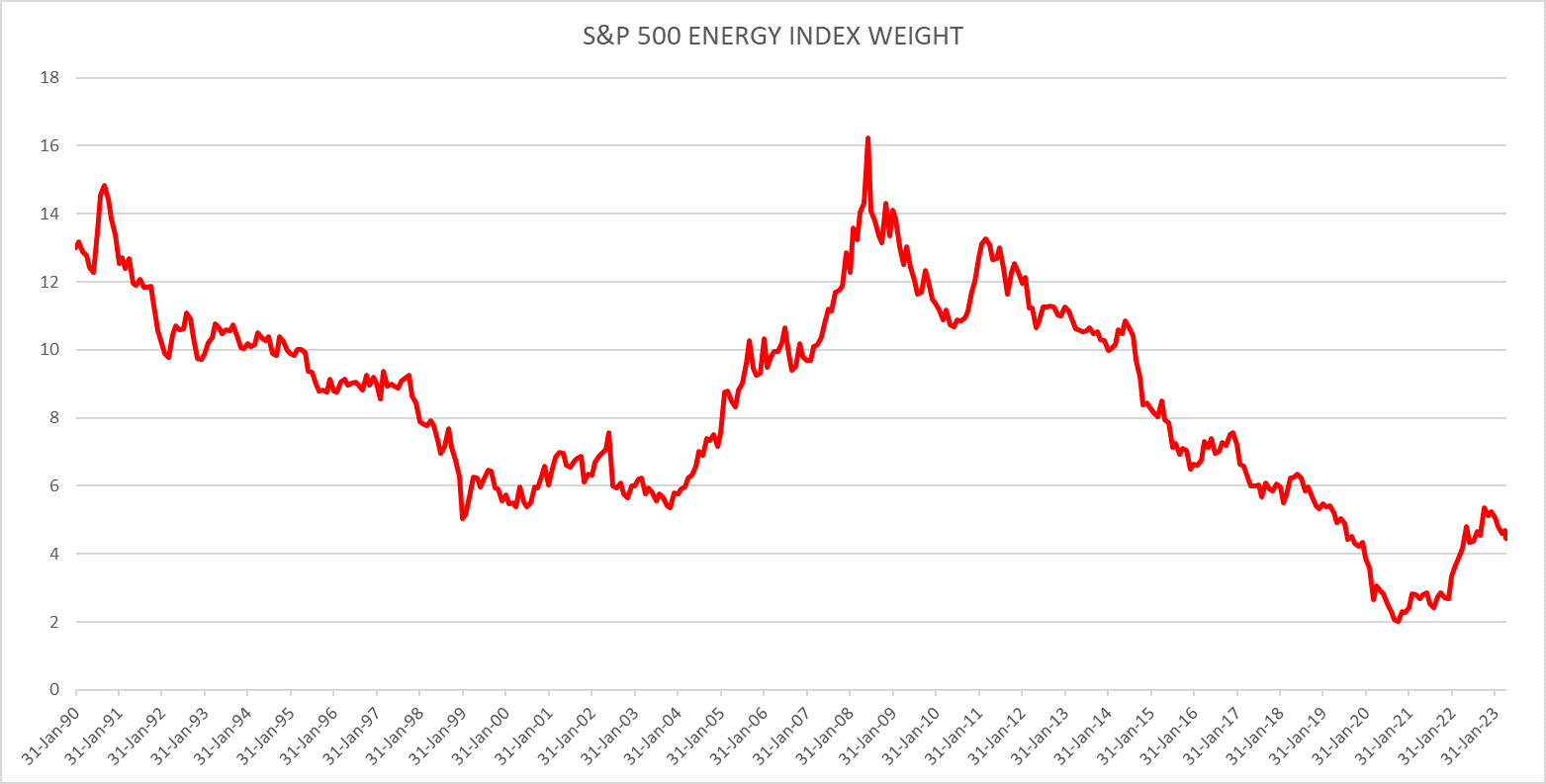

OXY is on both lists because they are big enough to buy smaller companies and are a very attractive acquisition candidate for these bigger companies (not to mention European majors like Shell, BP and Total). The bigger companies got valued much higher as large investment firms like Fidelity, Vanguard, BlackRock and others were forced into buying the largest companies. They were incredibly under-invested in oil and gas and they got involved in a way that their money wouldn’t distort prices. Their effort did cause huge moves in the largest-cap oil stocks like Exxon (XOM) Chevron (CVX), Conoco (COP) and OXY. Cole Smead, my co-portfolio manager, dubbed it “shooting a firehouse into a teacup!” Look at the chart of the entire energy sector as a percentage of the S&P 500 Index going back decades:

Source: Bloomberg.

It is not hard to understand why Buffett likes owning OXY and CVX. Currently the energy sector is 4.4% of the S&P 500 Index and makes 15% of the profits of that index. The balance sheets of companies like OXY are much stronger than before and improving quickly with copious free cash flow and high returns on equity. Oil and gas companies provide economically addictive products which the U.S. economy won’t be able to live without for decades.

The irony is that OXY shows up as a potential acquirer and an attractive acquisition target, especially for European major oil producers, like Shell, that are moving their focus away from drilling for oil. This movement is forced on them by the militantly aggressive environmental attitudes on that side of the Atlantic Ocean.

We see two scenarios for what might happen for us in the “Oil Dating Game.” First, we could get rich over the next ten years in the oil business. Second, Munger was very dour about forward returns in the U.S. stock market and success in the oil and gas business would mean we could avoid stock market failure.

Warm regards,

William Smead

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2023 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com