Dear Fellow Investors,

Over a three-year time period, stock prices tend to mean revert. This has spawned numerous investment approaches which try to squeeze capital gains out of those reversions. Classic deep value investing, as popularized by Benjamin Graham at Columbia Business School, taught that you would succeed by buying fifty-cent dollars and selling them when and if they reverted to the mean. The “Dogs of the Dow”strategy of buying the ten highest yielding Dow stocks was born out of mean reversion.

Over long-time periods, common stock performance falls on a bell curve like the one listed below. Half the stocks outperform and half underperform. Among the poorest performers, some go to zero and five percent of common stocks do so poorly that they can ruin a concentrated stock portfolio.1

On the other hand, five percent of the winners make enough money in a concentrated portfolio over twenty years to cover numerous 20-40% losses along the way. The Bible states that love covers a multitude of sins. In a 25-stock portfolio, a stock that goes up ten-fold in 20 years covers quite a few 20-40% duds. What do you have to do to avoid big losers, let mean reversion be your friend, and allow time to gain the most advantage out of the bell curve?

First, you must stick to quality companies in an attempt to avoid total disasters. In our case, we require a long history of profitability, consistent free cash flow, wide moats and strong balance sheets. Every business goes through rough periods, but if you have a strong balance sheet and sustainably consistent free cash flow, those periods are very survivable.

Second, you must constantly ask the question, “Where am I wrong?” Everyone makes stock picking mistakes, but all the stocks which go to zero had to drop 40% first. Pulling your weeds is the hardest thing to do in portfolio management, but it is amazing how you get rewarded over the following years by leaving more capital to long-duration winners and planting new seeds. Like everyone else, we said goodbye to quite a few companies in 2008. We were rewarded in 2009-2014 by the quality of the remaining list and the new things we bought with the proceeds of selling poor performers.

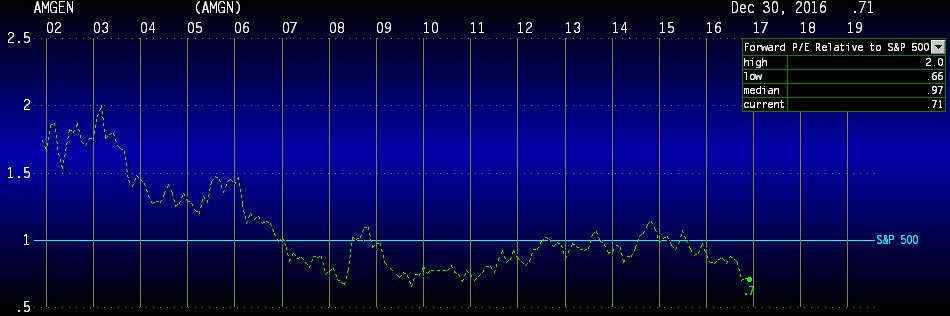

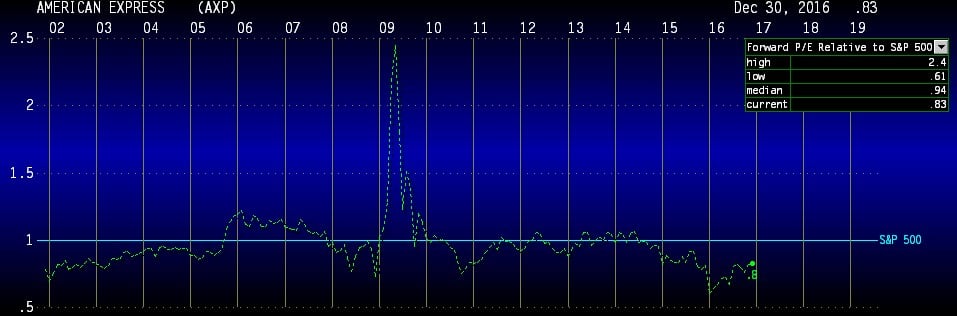

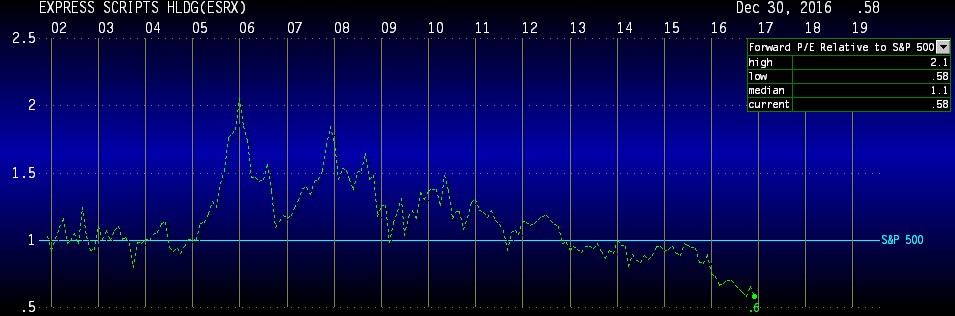

Third, mean reversion works and valuation matters dearly. Combining quality with bargain prices is what our whole portfolio management discipline is built on. All the academic studies (Fama/French, Bauman/Conover/Miller, David Dreman, Francis Nicholson, etc.) prove that the cheapest stocks outperform the average and expensive stocks. There are no guarantees, but here is how relatively undervalued a few of our stocks are as compared to the stock market over the last 20 years:2

It appears to us that many healthcare companies are prepared to revert to the mean in a positive way in the next three years. To gain the most benefit out of mean reversion, you must buy quality companies in industries which are deep in the doghouse. The psychology of holding out-of-favor securities while other investors are rocking and rolling (like in 2016) is what stops most market participants from gaining the three-to-five year reversion alpha.

Fourth, enjoying the benefit of the bell curve has two components. Mathematically, in a 25-stock portfolio, your biggest twenty-year returns will come from five stocks. If you sell much of your biggest winners, you reduce the possibility of covering a multitude of 20%-40% losses on the poor performers. We use the term “maniacal pricing.” We only sell winning stocks when their share price gets very high in relation to the history of the company. This could be 20 price-to-earnings ratio on a bank or 35-times earnings on Starbucks (SBUX). Our decades of experience in the U.S. stock market help us to understand when the temperature of an S&P 500 company gets maniacally high.

The second component is the cost savings you get by holding your winners to a fault. Low portfolio turnover is the ideal ingredient to add to high quality bargain stocks. The most recent study of U.S. large-cap equity funds showed that turnover averaged 62% and cost the portfolios involved around 80-85 basis points (.80-.85%) on average, per year. If you back that out of portfolio results, it means a majority of stock pickers out-picked the S&P 500 Index. As a side benefit, low turnover also keeps the tax man from visiting your stock portfolio as much as those who turn their portfolio much faster.

The pressure to outperform all of the time leads stock pickers to constantly seek mean reversion trades. It is our opinion that the extremely unusual success that Warren Buffett had at Berkshire Hathaway is tied to the fact that he took advantage of mean reversion only in companies that fit his favorite holding period, forever.

The great investor, Michael Price, said, “The fewer decisions I make, the smarter I am.” At Smead Capital, we spend our time wondering where we are wrong, looking for quality companies to buy for mean reversion and holding existing winners which are not maniacal. We’d like to think that 2017 will be a year where practicing our discipline will lead to three-to-five-year rewards.

Happy New Year,

William Smead

1Source: empxtrack

2Source: Bloomberg

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO and CEO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

© 2017 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com.