Dear fellow investors,

On the insistence from a friend and a colleague, I watched the movie There Will Be Blood over the weekend. I’m a Daniel Day Lewis fan from his prior works like Gangs of New York, so was excited to watch this odd story. Lewis’s character Daniel Plainview is a silver speculator turned oilman who comes across an oil opportunity in Little Boston, CA. He takes his son (HW) to a property, owned by the Sunday family, that they are told contains oil. He tells the owner that they are going quail hunting, which wasn’t true. While hunting, HW stumbles upon an oil seepage confirming the oil is present on the land. They are both excited and the following scene ensues with his son:

HW (son): How much we gonna pay them?

Daniel (father): Who’s that?

HW (son): The Sunday Family

Daniel (father): We’re not going to give them oil prices. We’ll give them quail prices.

While we are not claiming to be getting our oil companies for birdfeed, it brings up the idea of distraction for the Sunday family in the movie and investors now. The Sundays had strangers show up looking to hunt quail, not knowing they were looking for oil. Outside of one family member believing there was a ruse, they were willing parties when the sale price was negotiated at what looked like low prices in the movie. These people had never seen oil drilled on their land, thus didn’t understand the opportunity that lied ahead.

Today’s investors are different in their naivete. It’s not that investors are thinking they are getting a better secondary use (quail hunting) in today’s prices. It’s the view of what our world will be in 10, 20 or 50 years that is clouding their judgement. Little Boston had never seen oil. Investors and government of the world can’t see a world with oil at some point in the future.

Over the weekend, a Bloomberg article written by Jeran Weinstein and Michael Bellusci got to the core of this question. “Investors must now weigh the industry’s soaring revenue and improving profitability against the long-term prospect of a carbon-light world. The key is how long it will take for countries to phase out internal combustion engines in the coming decades and what kind of supply and demand imbalances occur along the way.”

The real question relies on when. For example, based on the large cash flows being produced in the energy space currently, investors can perceivably see investment returns that would pay back their initial capital in 5-10 years, based on current prices. They do not have to look deep into the future to understand success in investment returns.

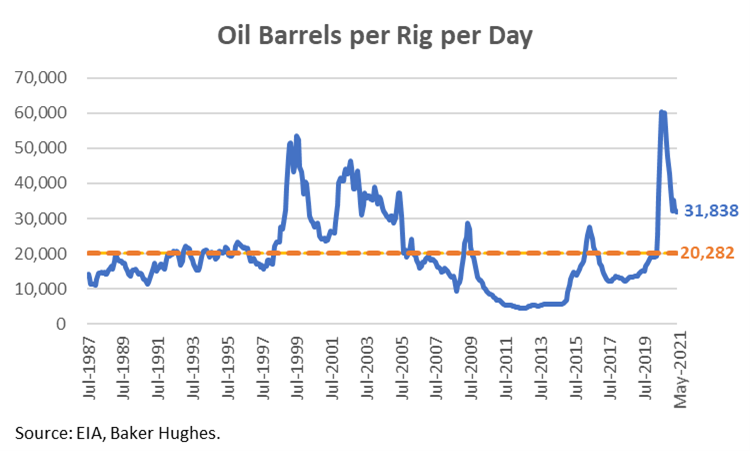

To understand the under-investment that is going on the oil business particularly, below is a chart showing oil barrels per rig per day since 1987.

What this shows is that we’ve never had so much oil produced per rig in the field. There are two possible outcomes. This level of production is causing the oil industry to have very large free cash flow because rigs are not being added back in capital expenditure allocations. The second outcome is that we are witnessing one of the largest under-investment periods we’ve ever seen.

Do not forget that oil is only 2.45% of the S&P 500. Thus, good economic results don’t change anything for the average investor. Further, some investors are unwilling to look at the space at all, not because the cash returns are good. They have decided they won’t be involved based on their view of climate change or other things like ESG. In my mind, ESG points to electric vehicles (E), solar power (S) and God, no oil (G). These views continue to point to a future where there is under-investment, not more historically normal levels of investments in the oil business.

Even if we focus more acutely on electricity production over the last 10 years, we can see that 1-billion-megawatt hours of coal production has come out of the electricity grid annually. What has replaced this? 60% of that has been replaced by natural gas, followed by the other 40% being replaced by solar and, predominantly, wind. This movement seems antithetical to the rationale being talked about on financial media today. Why look at the US? It’s not as far along as Europe in the use of non-fossil fuels for electricity, but it is head and shoulders above China and the developing world. We don’t believe investors understand where global economic activity is leading us in total demand for fossil fuel products. When we say that, we could care less about coal (though China does). We care about our oil and gas investments in that statement. The psychology seems backwards or, like the Sunday family, very distracted for what lies ahead.

This brings me back to the dialog in the movie from earlier. If I had the same chance to sit down with my only son Carter to talk about what we’re doing in our business for our investors, the dialog transcript would read:

Carter (son): How much we gonna pay them?

Cole (father): Who’s that?

Carter (son): Stock market investors in energy companies

Cole (father): We’re not going to give them oil prices. We’ll give them very green ESG prices.

Warm regards,

Cole Smead, CFA

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Cole Smead, CFA, President and Portfolio Manager, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2021 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com.