Dear Fellow Investors:

When I was ten years old, my Dad asked me if I’d like to make some money. Those of you who know me are aware the answer to that question is almost always yes. Dad offered me the chance to plant two rows of tomatoes in his one-acre garden. I would weed and water the two rows with the hopes of selling the fruit of my labor to the grocery store in my hometown of Washougal, Washington.

The vegetable gardener’s fate is very much tied to God’s common grace. Would this be a season of warm sunshine, or one of too much rain? Inevitably this raises the question: should the gardener toil if he expects a bad year? You see, the gardener’s skill rests not only in the selection of high-quality seeds and proper soiling, but also—and perhaps most importantly—in his patient perseverance, especially during periods of blight.

Blight is a fungal disease marked by the formation of lesions, withering and death of plant parts. As I remember it, our tomatoes got hit by blight about once every five years, nearly wiping out the entire summer’s tomato crop.

Common stock investing works very much like a garden. Choosing the most attractive securities is like shopping for seeds, saplings and the piece of ground you will farm. We prefer our eight criteria for common stock selection. They are a mixture of qualitative characteristics (consistent profitability, copious free cash flow, strong balance sheet, etc.) and bargain finding mechanisms (cheap in relation to the last five years and strong insider ownership, preferably with recent purchases).

Just as the lowlands near the Columbia River were fertile ground for tomato plants, we seek out fertile ground for our stock-selection methodology. We plant our capital in mostly large-cap stocks, which we find fertile and attractive when they tend to be out of favor or misunderstood by investors.

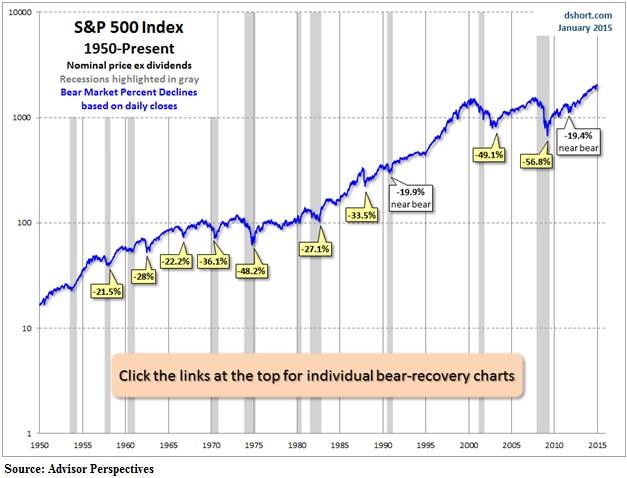

We think the reason most investors do not gain the benefit of common stock ownership stems from the blight which comes along about once every five years on average in the stock market. We call this blight a bear market and it usually consists of a decline of greater than 20% in price from the prior stock market peak. There have been nine declines of that magnitude since 1950 in the S&P 500 Index. Three of those declines exceeded 40% and two of them were in the last 15 years.

Almost all the recorded history of stock market participation shows that investors make every attempt to avoid the bear. The psychological pain of losing is much more powerful than the joy of making money. Many investors live in fear that the next decline will ruin their financial plans. For this reason, entire industries have been created to eliminate the volatility and the variability of stock price performance. The complexity of “smoothing” stock market returns and the expense associated with doing so cripples the long-term returns historically offered by diversified common stock ownership.

Think of my Dad’s one-acre garden. Imagine that he paid some serious money to have a fungal and weather expert come by at the start of the growing season in Washougal. If the expert said that there was a likelihood of blight that year, he should consider not spending his money, time and effort to plant tomatoes. The problem with a garden and the problem with common stock investing is there has never been any academic proof that you can predict the blight that hits tomatoes or the blight (bear markets) that hits common stocks.

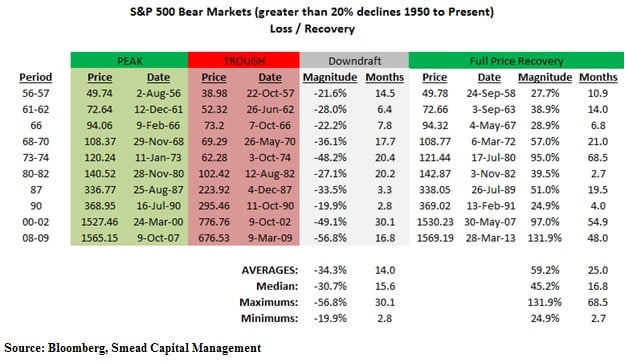

We at Smead Capital Management believe that many individual investors, financial professionals and institutional investors are avoiding U.S. large-cap common stocks under the theory that the next blight is just around the corner. The historical stock market evidence proves that temporary losses disappear in a reasonable amount of time in the same way an abundance of tomatoes are harvested in non-blight years. The chart below gives us that information:

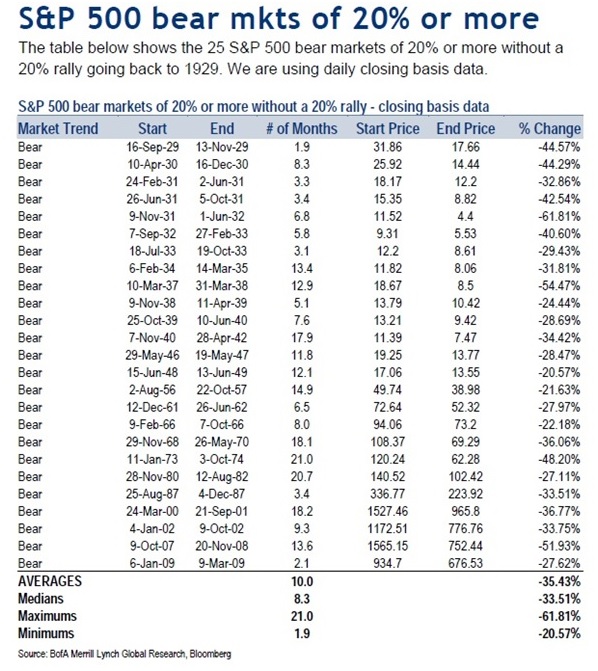

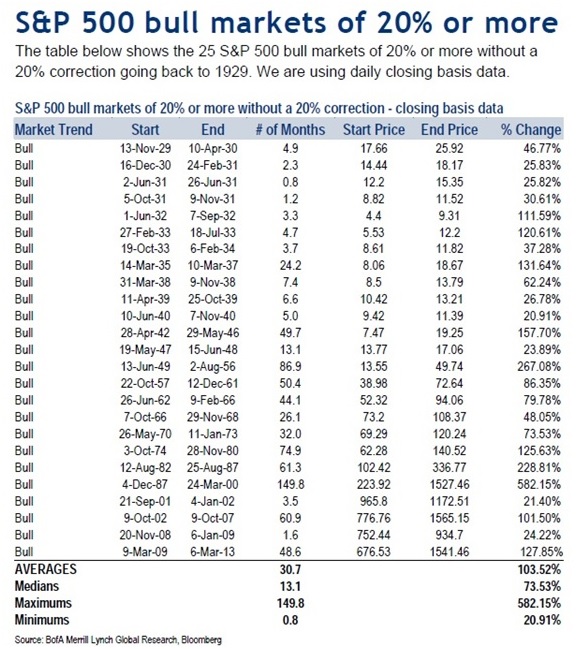

Lastly, a study of every bear market (blight) since 1929 and every bull market since then provides a very encouraging picture of the risk-reward relationship in long-duration common stock ownership.

The average bear market lasted 10 months and saw a decline of 34.3% in price. The average bull market lasted 30.7 months on average and gained 103.52%. It is this kind of positive sum game which warms our hearts and pocketbooks. I think about this by picturing my Dad in a normal year with enough boxes of tomatoes from July to October to feed a small army.

As for my garden in 1968, we fortunately did not get hit by blight. I managed to sell my tomatoes to the local Thriftway store and received $55 for my harvest. The whole process took about four months (a lifetime to a 10-year old) and the life lessons were huge as delivered by my Dad.

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com