Dear fellow investors,

As we have been holding calls with prospective and current investors of our firm, we have been arguing that the stock market is underwhelming the success of the economy. The lift off in economic activity could be far more troubling to stock market investors than their giddiness merits. The song that continues to come to my mind is David Bowie’s “Space Oddity” as we believe that today, unlike the past 10 years, is an economic oddity.

Ground Control to Major Tom

Ground Control to Major Tom

Take your protein pills and put your helmet on

Ground Control to Major Tom (ten, nine, eight, seven, six)

Commencing countdown, engines on (five, four, three)

Check ignition and may God’s love be with you (two, one, liftoff)

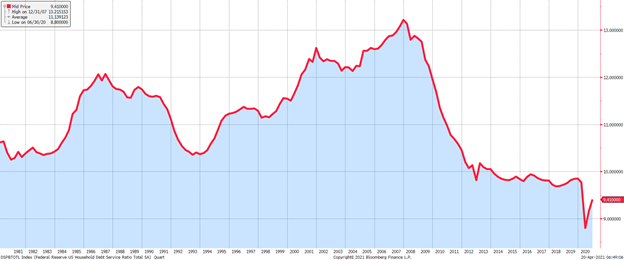

In 2007, the household debt service ratio struck the highest level recorded by the US Federal Reserve, since they began tracking this data in 1980. Americans had never had such a large percentage of their gross income going to debt payments of any form. Further, personal savings rates when I entered the investment business (2006) were negative. We were borrowing more than we made. Luckily, the drastic psychological and interest changes since then caused us to move to the opposite end of the room. Below is the household debt service ratio since 1980:

Source: Bloomberg.

Like Bowie sings, we’ve taken our “protein pill and put your [our] helmet on.” We did what was necessary in US households to free our income from debt, but at these levels our ability to borrow for purchases like homes, cars, home improvement and home goods is legendary! The strong economy of the mid-1980’s and the 1990’s were set up by other low points in the household debt service ratio. However, those numbers make the current depressed level of borrowing relative to income look like a dream.

This is Ground Control to Major Tom

You’ve really made the grade

And the papers want to know whose shirts you wear

Now it’s time to leave the capsule if you dare

“This is Major Tom to Ground Control

I’m stepping through the door

And I’m floating in a most peculiar way

And the stars look very different today

For here

Am I sitting in a tin can

Far above the world

Planet Earth is blue

And there’s nothing I can do

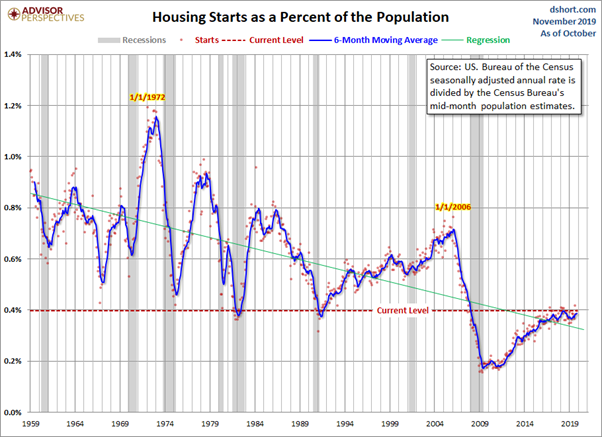

American households have “made the grade” more than at any point over the last 40 years. As investors can see from the US housing starts chart below, we are at a different point in this economy than we’ve been for a long time.

Source: US Bureau of the Census and Advisor Perspectives.

Homes have real demand as millennials recognize that “now it’s time to leave the capsule if you dare.” They have dared to move to suburbs like Greenwich, cities like Boise and metro-areas like Phoenix-Scottsdale. They are “stepping through the door” of their houses. The fact that it took an act of God to make these decisions is the “most peculiar way.”

Despite all the prospects for the economy and the activity that we believe is highly probable, “Planet earth is blue.” Investors don’t trust the economy’s prospects. They believe that housing is in the twilight of its 10-year opportunity, not closer to the lift off. They are blue on economic growth, blue on interest rates and inflation. “And there’s nothing I can do” to change their opinion. The markets are there to serve us as investors, not instruct us. For investors that believe the grim psychology of today is far overblown and blue, welcome on board. “Commencing countdown, engines on. Check ignition and may God’s love be with you.”

Fear Stock Market Failure,

Cole Smead, CFA

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Cole Smead, CFA, President and Portfolio Manager, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2021 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com.