Dear Fellow Investors:

Warren Buffett says, “What the wise man does in the beginning, the fool does in the end.” In a Barron’s feature over the weekend, writer Andrew Bary dug into the portfolio of Harvard’s Endowment through an interview with their CIO, Jane Mendillo. After all, who could possibly be wiser than what many would argue is the most respected undergraduate and graduate university in the world? Using a combination of Bary’s article and our perspective, this missive will seek to determine whether the Harvard Endowment is wise or foolish.

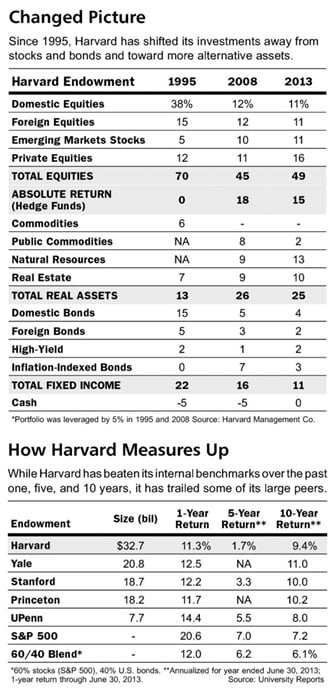

First, Bary pointed out how poorly that Harvard had done in the five years ended June 30, 2013:

Harvard was up 1.7% annually in the five years ended in June 2013, ahead of its benchmarks in a policy portfolio—or targeted asset allocations—by 0.5 percentage points, but behind endowments at peers such as Stanford.

Second, he showed via the chart below that Harvard’s endowment would have achieved better returns with a 60/40 stock/bond mix over the last five years.

Lastly, the same chart also shows how stubbornly Harvard has held onto the same basic asset allocation it had at the end of 2008. We at Smead Capital Management wrote what we think was a seminal piece on the subject of wide asset allocation in the summer of 2011. We argued that 1999 might have been the single best time to widely diversify in US history by calling it “Asset Allocation Nirvana.” Unlike Harvard, we called July of 2011 an “Asset Allocation Nightmare.”

We believe contrarian thinking helps explain why both of these points in time were so critical. In 1999, a 17-year bull run in stocks and a massive bubble in technology stocks caused the S&P 500 Index to be its most expensive in history by measures of price-to-earnings (P/E) and price-to-book value (P/B). All other asset classes were out of favor and starved for capital. Wise endowment leaders at Yale (David Swenson) and Harvard made a big move into wide asset allocation to get away from large-cap US stocks. It proved to be wise, but lonely. It was wise to move into that sphere, but lonely to be one of the few institutions moving against the grain.

We like to say that 80% of the long term gains go to 20% of the investors. Therefore, we believe you always have to be concerned when a “well known fact” causes 80% of the institutional investments to be in agreement with each other. As late as the end of 2002, endowments as represented by the NACUBO Commonfund study showed US equity at 52% of the average portfolio.

In the summer of 2011, we were at the other end of the spectrum. US large-cap stocks had performed atrociously over the prior 12 years. The asset classes which received the lion’s share of the diversification away from US equity set the world on investment fire. Oil went from $11/barrel to over $100/barrel and Gold went from $250/ounce to over $1800/ounce leading a decade of performance for commodities as good as any in US history. China’s booming GDP growth triggered a love affair with emerging markets like Brazil, Russia and Indonesia. Bonds of every shape and form saw interest rates drop providing superior returns to stocks.

We believe the question for today can be answered by examining Harvard’s endowment against the other institutions and high-net-worth individuals who own most of the wealth in the US. Are they being wise or foolish? Here is the NACUBO- Commonfund study for the year ended 2012:

From an institutional standpoint—and from ours—Harvard looks almost pedestrian today and is lodged squarely with the 80% crowd. Here is what Ms. Mendillo said to Bary when quizzed about avoiding US stocks, emphasizing alternative strategies and sticking to what appears to us to be a 1999 asset allocation mindset.

Harvard has just 11% of the portfolio in domestic stocks. Why would you want such a small allocation to the world’s biggest equity market and some of the best companies?

Private equity is a much more crowded place than it was 10 or 20 years ago. So you need to be choosy and pick the right managers and opportunities. It has been estimated there is a trillion dollars of dry powder in the private-equity industry today.

Mendillo freely admits that many of the asset classes like private equity are “over-crowded.” Her answer to being part of the 80% is the same one everyone makes when they are in a “crowded” trade—we have to be “picky and choosy.” It reminds us of those auto-insurance industry surveys which show that 80% percent of American drivers consider themselves above-average. She is effectively admitting that Harvard’s endowment has to squeeze blood out of a turnip. It is like avoiding dot-com stocks in 1999 and sticking to the “pickaxe” makers like Microsoft and Cisco. It kept 2000-02 bear market losses down to 60-85% in technology stocks, rather than losing most everything on dot-com stocks like Etoy, Geo-cities and the rest.

Mr. Bary made no effort to get her to explain how she has watched US stocks provide excellent returns since March 10, 2009 and why Harvard has made virtually no effort to catch this watershed turn of events. Look at the chart above again. Harvard’s endowment had US equity in 2008 of 12% and in June of 2013, 11%. We have argued for two years that with institutional investors massively under-allocated to US equities that any corrections would be contained to less than bear market status. Our argument is that the largest owners of wealth in the US couldn’t possibly flood out of stocks in any meaningful way, because they barely own them in the first place. Mr. Bary’s overview of Harvard’s endowment provides us confirmation of our contrarian belief.

Warm Regards,

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com