Dear Fellow Investors,

At the end of my freshman year in college (1977), my brother-in-law’s twin brother called me to ask if I wanted to go to the sixth game of the NBA Finals in Portland. I was a huge Trailblazer fan and was thrilled to sit in the top row of Memorial Coliseum, which held 12,665 fans. Not only was it an unbelievable experience for a lifelong fan (the Blazer’s won), but it was even more powerful because professional basketball was “the only game in town.” No other major professional sport (football, basketball, baseball) existed in Portland in 1977 and there is only one in town today.

Whenever we are being vetted by investment organizations we are asked what kind of stock market environment we are likely to underperform and our answer is always the same. Studies show that meritorious stock picking disciplines outperform the indexes 60-65% of the time. The historical 35-40% of the time we have underperformed usually came in a stock market environment where a narrow group of stocks were very popular and appeared to be the “only game in town.” We have been in one of these for a while and we thought it would be helpful to dig into the subject.

There are two environments where we are likely to lag. The first environment is a stock market led by companies which are cyclical, heavily indebted and dependent on sharply rising commodity prices. The era from 2004 to the middle of 2008 was lousy for stocks in general, but was especially lousy if you were not deeply over-weighted in energy, basic materials and heavy industrial stocks, which had the China economic boom temporarily behind them. We lagged that era as companies which fit our eight criteria for stock selection weren’t connected to “the only game in town.”

The second type of market we lag is when the most futuristic and exciting technology and growth companies capture the imagination of investors. Price-to-earnings (P/E) ratios and price movements get divorced from the underlying businesses as investors discount earnings very far out into the future. We believe that when you get into this situation, the gains which are made in the remainder of the bull market for the expensive/glamorous stocks will get crushed in the decline which follows. We try to avoid these companies and those closely related because we think “if there’s a hurricane coming in Miami, we don’t want to be in Palm Beach.”

Let’s review the last and most prolifically-euphoric tech episode where value investor disciplines like ours underperformed back in 1998-2000. By the spring of 1998, the heat got too hot in the kitchen for us. We avoided the dotcom stocks which traded at the highest P/E ratios or had losses. We also avoided the so called “pick axe” companies which were expensive and profitable. On top of that, we got out of our remaining holdings in less egregious tech stocks like IBM (IBM) and Hewlett Packard (HPQ) (they were effectively “in Palm Beach”).

The easiest way to understand why you don’t want to make money from the late stages of an expensive/futuristic stock boom is to look at what were considered the lowest risk ways to play the 1990s boom. Microsoft (MSFT), Intel (INTC) and Cisco (CSCO) were considered “pick axe” companies to that boom because they were not dotcom flashes in the pan and were drafting on all the activity requiring their software, chips and routers created by the “internet revolution.”

Microsoft’s high stock price in 2000 was $58.38. It bottomed at $17.10 in early 2009. Today, Microsoft is projected to earn $3.02 in 2017 (Value Line). This means the stock sold in 2000 at 19 times 2017 earnings per share. Is it any wonder that investors have only seen 20% appreciation from the height of the Tech Bubble?

Intel and Cisco are even worse. Intel peaked at $66.75 in 2000 and they are projected to earn $2.80 in 2017 (Value Line), which means they traded at 23.8 times 2017 earnings back then. Cisco traded at $77.31 per share at its 2000 peak and bottomed two years later at $10.49. They are projected to earn $2.40 per share (Value Line). They traded for 32 times what they would earn 17 years later. This only happens when you are “the only game in town!”

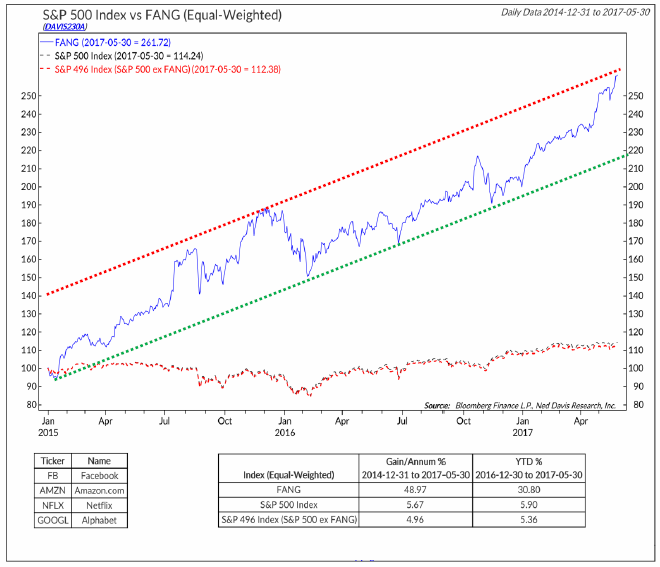

Are we doing something very similar today? Here are the P/E ratios of the FANG stocks, Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Alphabet (GOOGL, formerly Google), based on Value Line estimates:

- • FB–$4.75 in 2017, P/E ratio 32

- • AMZN–$7.95 in 2017, P/E ratio 125

- • NFLX–$1.10 in 2017, P/E ratio 148

- • GOOGL– $35.00 in 2017, P/E ratio 29

A quick glance at these numbers shows that AMZN and NFLX are certainly as expensive as Cisco and other glamour large cap stocks were in 1999. FB and GOOGL are less expensive — or like what Microsoft, IBM and Hewlett Packard were in 1999. Therefore, as we consider how this might play out, we will ask how the FANG stocks became “the only game in town.” FANG dominance is best represented by their gains since the beginning of 2015 as compared to the gains in the remaining stocks in the S&P 500 Index. The chart below shows that the FANG stocks gained 48.92% while the remaining stocks gained 4.96% on an equally-weighted basis1:

How did this set of circumstances develop?

Interest rates have stayed historically low

In theory, both Warren Buffett and Ben Inker have explained recently that the lower the interest rate the more valuable earnings are way out into the future. In the absence of riskless returns, why not take more risk for your returns? The answer to this question has been yes, yes, yes and yes!

Slow economic growth has persisted

With economic growth anemic compared to prior economic recoveries, investors have been willing to pay up for demonstrable earnings growth, and even more so if the growth is futuristically exciting.

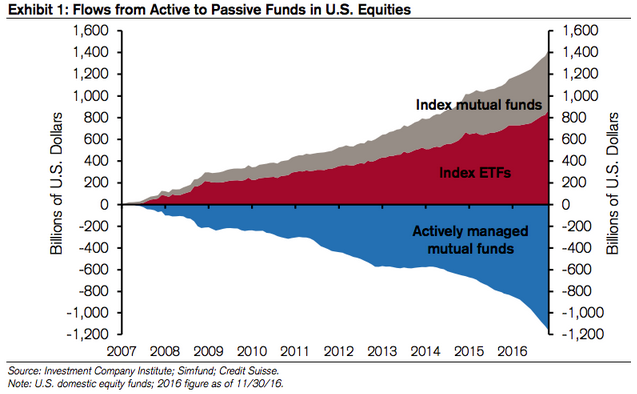

Indexing has become wildly popular2

Since the FANG stocks and technology in general are heavily weighted in a capitalization-weighted index like the S&P 500, the flood of money into indexing automatically rewards FANG and tech stocks in a “virtuous circle.” Finally, here is what Charlie Munger has said about situations like this: “Mimicking the herd invites regression to the mean.”

Everyone wants to know how and when this ends. Our answer is the same as Warren Buffett’s, our job is to determine “whether” and the market’s job is to decide “when.” For the benefit of our investors, we will throw out a few possibilities:

- 1. 1. At some point, there are no buyers left to buy. Margin debt is at record levels and a great deal of it must be attached to tech stocks.

- 2. It will be hard for the culture to gratify the leaders of tech companies any more than it has. CNBC spends all day talking about tech and the major magazines (popular culture and finance-oriented) have had the FANG leaders on the cover constantly. Is there another level of aggrandization that we can ascribe to these leaders?

- 3. The ridiculous commercial real estate as testament to the success of these companies has already been put in place in Palo Alto, San Francisco and in our hometown, Seattle. Gaudy buildings have been built at the top of prior financial euphoria episodes and this one is covered.

- 4. The excitement surrounding the FANG stocks is pulling attention away from a baby boom among 30-45-year-old women in the U.S. and a huge resurgence in household formation. Stronger economic growth and higher interest rates would cripple a key component of the tech mania thesis.

- 5. The next bear market in stocks. The ‘Nifty-Fifty’ stocks of the early 1970s got crushed by the 1973-1974 bear market. The tech stock mania of 1997-2000 blew up in the 2000-2002 bear market. They were “the only game in town” in the prior period. Ironically, most of the 40% decline in the S&P 500 in 2000-2002 came from tech stock and related company declines.

We have no idea when this euphoria episode will end. However, we believe we know what to do with it. When a group of stocks gets mega-popular, we must avoid the area the same way we would avoid Palm Beach during a Miami hurricane alert. This is especially true when it is “the only game in town.”

Warm Regards,

William Smead

1Source: Stifel Market Strategy report, June 1, 2017

2Source: MarketWatch

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO and CEO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

© 2017 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com.