Dear fellow investors,

Thanks to reading Spencer Jakab’s book, The Revolution That Wasn’t, we’ve been thinking about what it is like to be in a short position when overwhelming demand affects prices. The Strategic Petroleum Reserve (SPR) was created for our National Defense and/or a temporary crisis in oil production. So far, it was effectively used by President Biden to calm oil prices down when they hit $120 per barrel. The Reserve currently holds around 500 million barrels of oil, down from the normal 700 million barrels.

President Biden’s action has backed off prices at the pump, but at some point, those reserves will need to be replaced. Investors know that it will be replaced and oil producers in the U.S. wisely bought oil from the Reserve and refined it. Therefore, they did what any wise business would do, keep their own oil production in the ground and help the President satisfy voters until the November elections.

As we’ve learned in the past, supply and demand dynamics win out over the long run. Here are the dynamics.

- Oil drilling and production have been anemic compared to prior cycles because of massive economic pressure to develop clean energy sources. Also, the oil and gas producers got castrated in 2016 and then slaughtered in the quarantine lockdowns when the Saudis let the price of oil go negative for a few days. To say they are gun-shy would be an understatement!

- There are 41.6% more Americans in the demographically important Millennial age group than in the Gen X group. When you combine the much larger group with geographic spreading due to escaping the downtowns of major cities, you have a recipe for higher prices. We drove recently through the Western U.S., and you could see houses being built in Bend and Klamath Falls in Oregon. Then we saw growth exploding in Carson City, Nevada, and all the way down Highway 395 to Bishop, California.

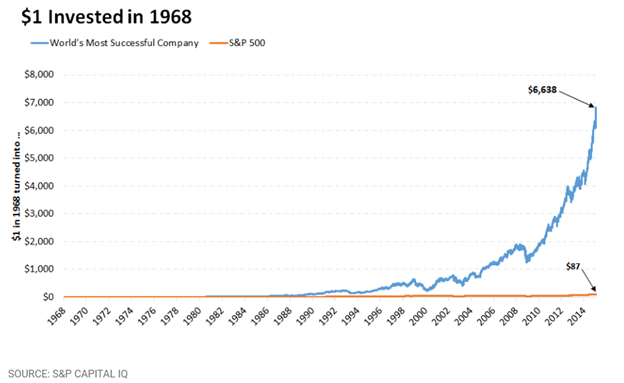

- There is no incentive to increase production for the major oil producers like we own (CLR, OXY, COP, CVX). It reminds us of the dynamics of the tobacco industry in the aftermath of the 1970 removal of the “Marlborough Man” by the Federal Government from the TV and radio airwaves. Over the next 40 years, adult smoking got cut in half, but the price of a pack of cigarettes went from 20 cents to $5.00. The State of California has mandated that gasoline-powered cars can’t be sold past 2035 and numerous similar initiatives are being discussed in other populous states. Below is the chart of Phillip Morris from 1968 to 2014:

- Even though the Federal Reserve Board is working to back inflation down by tightening credit, they can do nothing about the $6 trillion that the Trump and Biden administrations dumped into the system to fight the COVID-19 Pandemic battle. Any visit to a business that employs basic labor will tell you that wages are going up at the average to below average income levels. When wages go up for average to below-average folks, fossil fuel-powered wheels soon follow.

This brings us back to the story of small-time investors ganging up on short sellers on Robinhood or WallStreetBets or Reddit. They knew that short sellers would be forced to buy if they could group together and aggregate market power. What might happen if oil traders around the world begin to accumulate oil contracts around the time of the U.S. mid-term elections?

If demand holds due to demographic forces and the return to spendy metropolitan downtowns continues at current anemic levels, a short squeeze could develop. If you throw a cold winter on top of that heap of kindling, you could get heating oil and natural gas making another big move up. Fear stock market failure.

Warm regards,

William Smead

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2022 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com