Dear Fellow Investors:

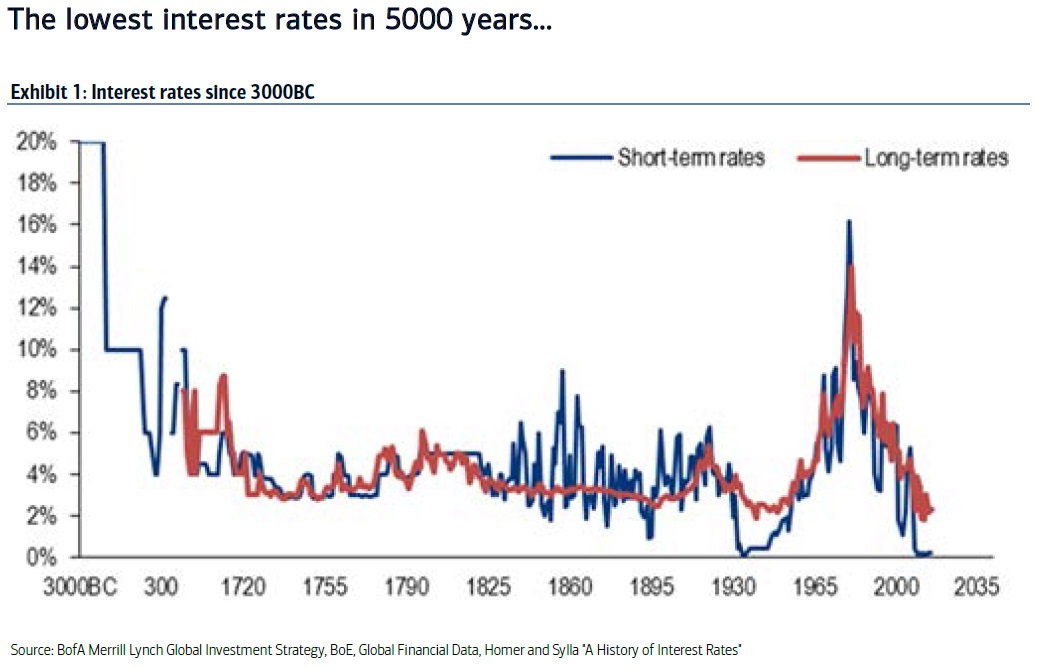

Time and coincidence often cloud our own perception. Consider interest rates. Baby Boomers and Generation Xers became adults (25 or older) between 1965 and 2005. During that period, these adults witnessed an aberration in the history of interest rates. They saw moments of monumental highs (20%) and levels consistently above historical norms. The chart below shows that long and short-term Interest rates in the United States have spent most of the last 400 years in a range between 3% and 6%.

We contend that this deviation clouds the judgment and expectations of many of today’s investors. There are numerous implications for long duration common stock owners arising from the examination of historical interest rates.

Intrinsic Value Computations

The father of value investing, Ben Graham, concluded through his years of research that ten-year corporate bonds averaged 4.4%. Therefore, in his revised intrinsic value equation, he used 4.4% as the numerator for adjusting intrinsic value based on interest rate fluctuations. This long-term interest rate chart supports the validity of his choice and is right in the middle of the 3-6% historical range. One could argue that long-duration equity investors have been using discount rates in their intrinsic value calculations much higher than historical interest rates justify. This is likely due to the aberrationally high rates of the period between 1965 and 2005, a recency bias.

Commitment of Capital to Bond Investments

In 1980, the prime interest rate at the major banks was 20%. Long-term Treasurys peaked at 15% in early 1981. Inflation topped out in 1981 at 11%. Thirty-year fixed mortgages were issued as high as 17%. What people didn’t realize at the time was that they were living through a five-standard deviation event, according to history.

Even if inflation had stayed at 11%, those interest rates offered investors very high inflation-adjusted returns. As the famous bond investor Bill Gross has argued, this laid the groundwork for more than 30 years of declining interest rates and a likely normalization back into the band between 3% and 6%. This has rewarded bond investors and addicted them to an asset-allocation commitment based on look back returns which are statistically unlikely.

Interest rates are currently below the historical 3-6% range and will likely rebound over the next ten years into the historically normal band. We believe common stock buyers should include that likelihood in their stock selection methodology, whether in their intrinsic value calculations or in the effect that higher rates in the U.S. have on the U.S. dollar and overall U.S. economic growth. We contend that the surprise in the U.S. will be how much stronger economic growth will be than what is expected. How else can rates go up unless someone demands the capital via borrowing?

Need for Solid Returns for Investors

Owners of wealth in the form of liquid assets have an economic need in both low and high interest rate time periods. They need to earn a return above inflation to defend the purchasing power of their liquid asset pool. Ownership of long-duration common stocks has proven to be superior to other liquid assets over long time periods, except for the ten-year stretch from 1999 to 2008.

As 10-year Treasurys fell to 1.6% in 2008 and stocks got liquidated in the financial crisis, two five-standard deviation events conspired to elevate bond investments in popularity and thrust bond portfolio managers into god-like status. We think a good rule of thumb is to avoid portfolio success stories created by five-standard deviation events. They only happen 2.5% of the time. Rather than being preoccupied with what the consensus of investors are interested in, we believe building our portfolio around high probability events is much more valuable to the long term investor.

Industries Benefitted By Higher Rates in the 3-6% Range

We have argued ad-nauseam that common stock investors have two possibilities in front of them as it pertains to interest rates. If interest rates were to rise back into the 3-6% historically normal band, there must be forces which demand the money and industries which benefit from the forces which cause the rise in rates. If rates stay below the historical band, intrinsic value calculations using discount rates above the historical average will undervalue common stocks.

Certain industries would welcome higher interest rates. Insurers must earn interest on collected premiums, banks would like to charge more for loans, and homebuilders would like to have so many customers for new homes that the resulting demand for money drives up interest rates. Consumer discretionary companies would love to see a level of prosperity which would drive retail sales and liberal advertising budgets. Drug and biotech companies would like everyone to be able to afford the fantastic new medicines they will introduce the next ten years.

In summary, above average returns don’t come along without taking risk. Investors have become very comfortable with today’s historically low interest rates and fear continued poor economic growth rates. Equity portfolio managers use discount rates higher than today’s actual rates because of the abnormally high rates of the last forty years. Lastly, the contrary long duration common stock investor should be attracted to industries which benefit from the gravitation back into the historically normal returns from the bond market.

Warm Regards,

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com