William Smead

William Smead

Chief Executive Officer

Chief Investment Officer

![]() Subscribe to the Missives Podcast

Subscribe to the Missives Podcast

![]() Click here to listen to this Missive

Click here to listen to this Missive

Dear Clients and Prospective Clients:

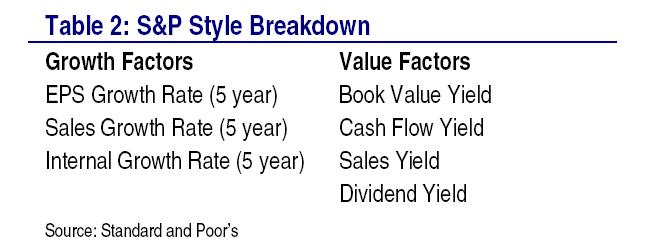

Oppenheimer’s Chief Market Strategist, Brian Belski, put out a great piece of research last week (“US Strategy Weekly: Shifting Focus to Value Over Growth”) on the composition of the companies which make up the Value half of the market capitalization of the S&P 500 Index. The index is divided into growth and value partitions by the factors listed in the table below. High ratios in the growth factors show investor’s expect a bright or growing future. High yields in the value factors infer low future expectations on the part of investors.

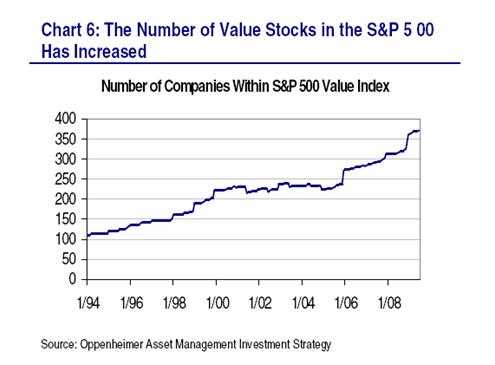

The two accompanying charts appear to “paint a thousand words” in the opinion of Smead Capital Management. The first chart shows the number of companies in the value side of the index has grown immensely in the last 15 years. We believe it is not unusual for this to happen in the aftermath of a major market decline.

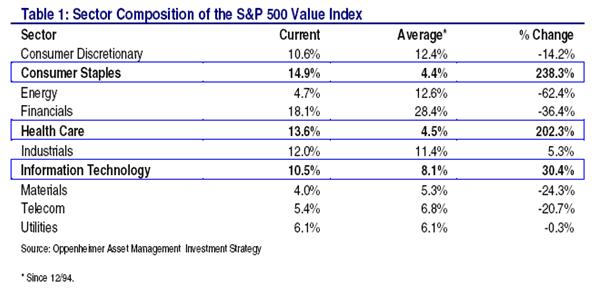

The second chart shows which sectors of the S&P 500 Value Index are the most over and under-represented in the S&P 500 Value Index today as compared to the average of the Value Index over the last 15 years.

We have only begun to decipher the “thousand words”, but here are a few. First, what would have caused the growth half of the index to require far fewer companies than before to equal 50 percent of the S&P 500 Index’s market capitalization? When the growth factors improved in the energy industry, investors moved massive amounts of capital into the sector. Energy is the most under-represented in the value side of the index (4.7%) compared to normal (12.6%). These energy companies tie up a massive amount of capital due to their capital intensive nature, taking money away from other sectors. Many other cyclical stocks hold above-average growth factors as the lemmings have overcrowded the BRIC trade, giving market premiums to capital and labor intensive companies. We have admired the stock picking of folks like FPA’s Robert Rodriguez and the sector analysis of Jimmy Rogers for 20 years, but they both need to consider that owning energy and living in Singapore is not lonely contrarianism today. If this was the course of action to take, we should move Smead Capital Management to the New York/New Jersey metropolitan area to be closer to the drug companies to show our bold contrarian spirit.

Second, what is over-represented in the Value half of the Index compared to normal? Consumer staples and healthcare, by a whopping margin! Consumer Staples represent 14.9% today versus the normal 4.4% in the value index while healthcare is 13.6% today versus its normal 4.5% weighting in the value half of the S&P 500 Index. Many of these companies have beautiful balance sheets, strong international brands, generate massive free cash flow and earn high returns on capital. We haven’t done the research yet, but we believe we will find that consumer staples and healthcare are normally as under-represented in the S&P 500 Value Index at this point in the cycle as energy is this time.

I heard Warren Buffett tell a story about raising money for his early partnership. We believe it does a great job of illustrating why we at SCM don’t want to own BRIC trade cyclical companies. He went to see the owner of the largest farm equipment dealer in Omaha when he was raising money for his partnership in the 1950’s. He asked the owner how he had done this year. The owner told him he had done great. Warren asked what he did with the profits. The owner went over to the office window and pulled open the drape. He told him that it was all sitting on the lot as he showed Warren the inventory for the coming year. In many cases, a great year in a capital intensive business leads to more capital expenditures and little free cash flow for investors. Consumer staple and healthcare companies have a history of producing consistent free cash flow which the owners/management of the company can use any way they see fit to enhance shareholder value.

Best Wishes,

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. The securities identified and described in this missive do not represent all of the securities purchased or recommended for our clients. It should not be assumed that investing in these securities was or will be profitable. A list of all recommendations made by Smead Capital Management with in the past twelve month period is available upon request.