“A situation or state of mind seemingly between reality and fantasy.”

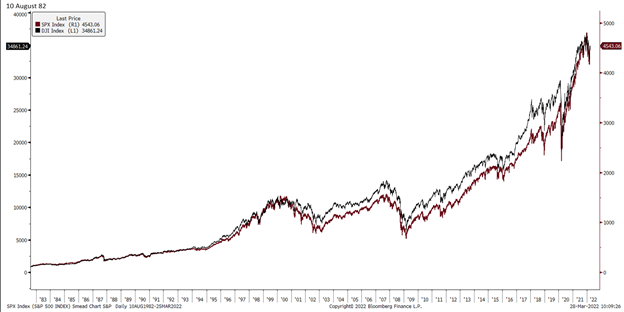

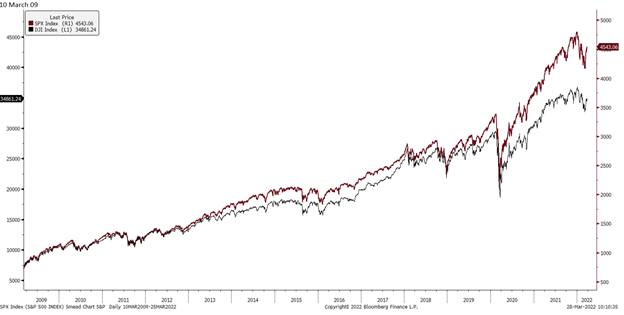

Depending on your age, the bull market in stocks started in 1982, with stocks trading at six-times earnings and the U.S. Treasury Bonds paying 15% interest, or in 2009 at the bottom of the financial crisis. Either way, the combination of the Federal Reserve Board’s liquidity and the popularity/stock market domination of technology stocks have entered us into what we will call “The Twilight Zone.”

Backward-looking returns indicate that these two periods have produced some of the most spectacular successes of the last 100 years:

Source: Bloomberg.</span

Source: Bloomberg.

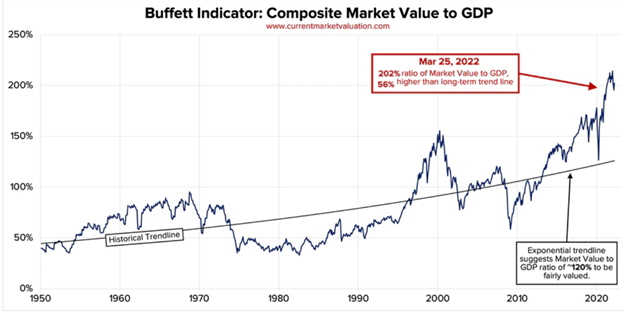

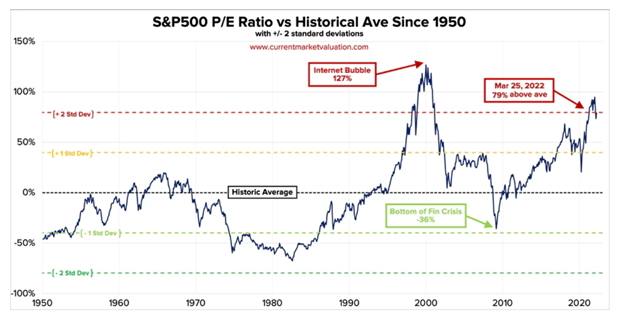

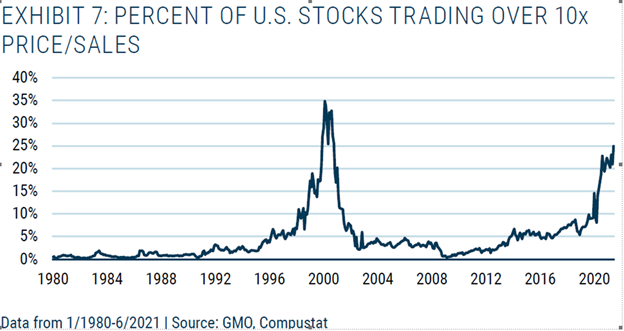

Where does this leave us? First, the U.S. stock market is incredibly expensive from a historical perspective as measured by Warren Buffett’s favorite measuring tool, household equity ownership and price-to-earnings (P/E) ratios.

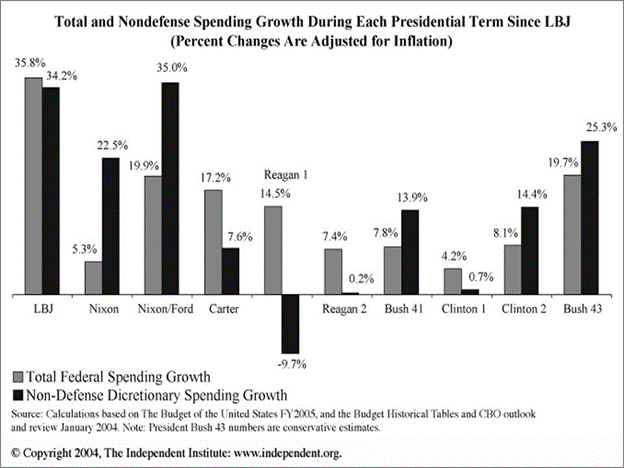

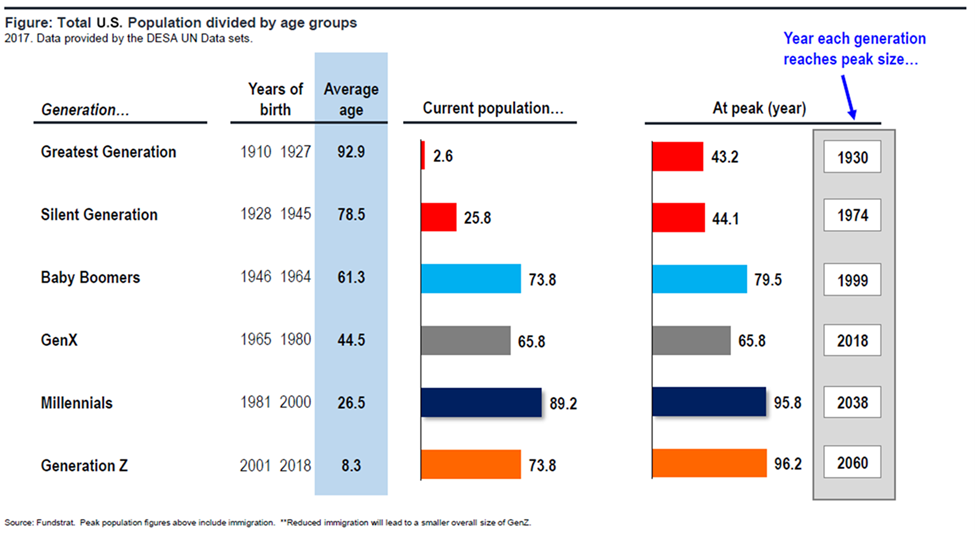

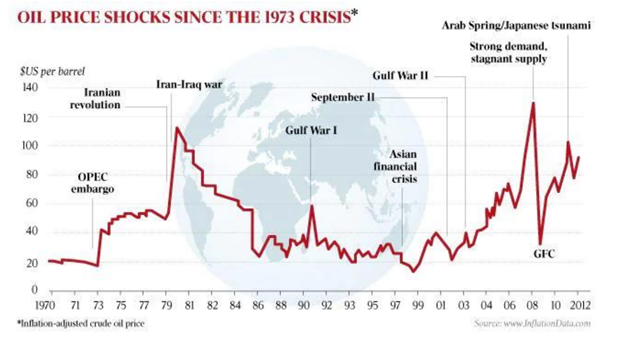

None of this was a problem until the bond market began to correct and the Fed Chairman, Jerome Powell, recognized that inflation is what we call a “wolverine” and is not “transitory.” The four preconditions of the 1970s inflation were the Vietnam War, Johnson’s Great Society legislation, the size of the baby boomer demographic group on a relative basis and the Arab Oil Embargo of 1973-1974.

As the sun is possibly setting on the great bull market of the last 40 years, we can just substitute the Pandemic War, the Trump-Biden Federal Government spending to combat the lockdowns, the size of the Millennial demographic relative to Gen X and the Arab Spring castration of U.S. oil production in 2020 to hear the “rhyme!”

Warren Buffett and Charlie Munger have said many great things in our time in the stock-picking business. Buffett has explained recently that interest rates serve as a form of “investment gravity.” He argued that low interest rates elevate stock prices and the move from 1982 to today has been more about higher stock prices via gravity. Economic growth was much higher from 1964-1981 than it was from either 1981-1999 or 2009-2019. They also have argued the Aesop was the guy who started investment logic when he said, “A bird in the hand is worth two in the bush.”

We are in The Twilight Zone of this bull market because the bond market is dragging the P/E ratios of “two in the bush” companies down. The chart below shows how dominant the “two in the bush” stocks were in the S&P 500 Index:

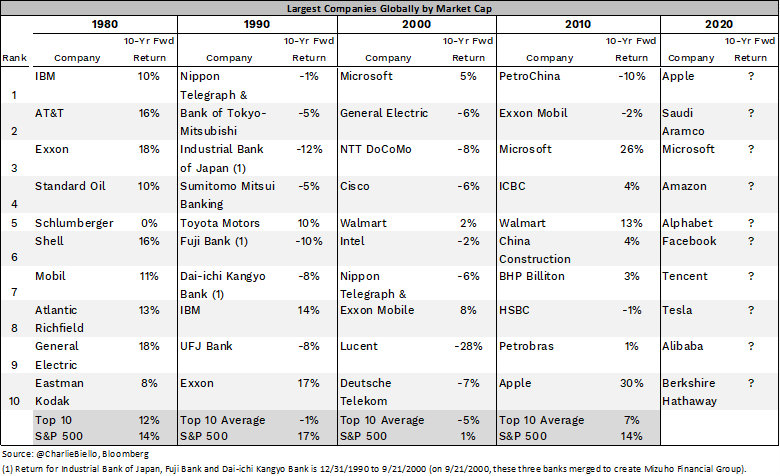

We are also in the Twilight Zone with the world’s largest capitalization companies. At the end of each decade, here were the ten largest, including how they did over the next ten years:

Despite having Buffett’s gravitational tailwind behind their P/E ratios, these lists underperformed the index four out of four times and lost money over the following ten years 50% of the time. Are those odds that you want stacked against you going forward?

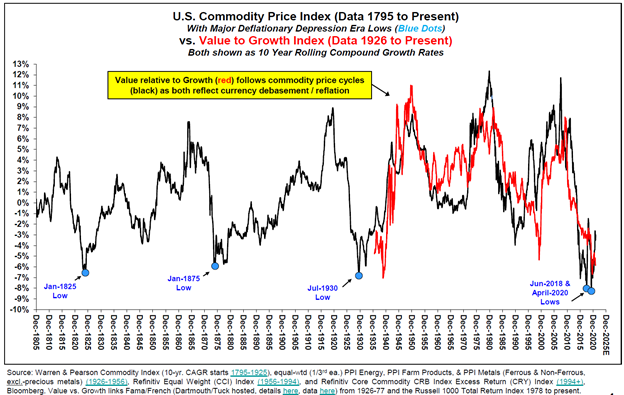

Now that you understand what investments are in the twilight of their bull market, let’s talk about what investments do well when bond rates rise, and inflation expectations get intertwined with stock market capitalizations. In other words, what investments could be just seeing the sunrise.

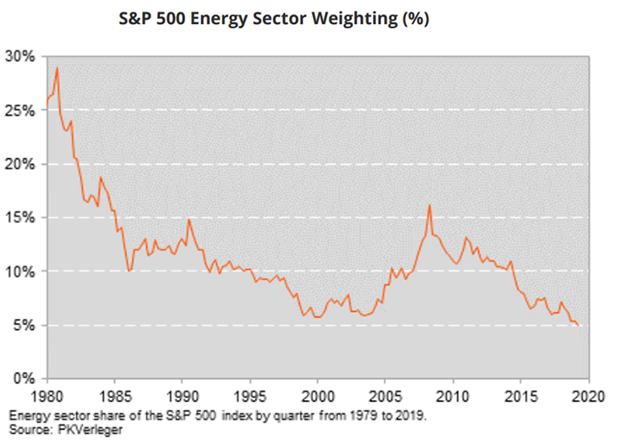

Commodities started a bull market in mid-2020 that we believe may have legs for at least a decade. Oil stocks were at the core of the inflationary momentum popularity in the 1970s and dwarfed the representation in the S&P 500 Index when inflation mattered the most in 1981:

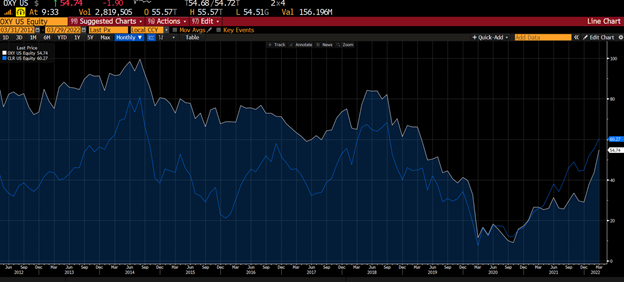

Our oil stocks, Occidental Petroleum (OXY) and Continental Resources (CLR), are lagging way behind the prevailing oil prices compared to 2014:

Source: Bloomberg. Data for the time period 3/31/2012 – 3/29/2022.

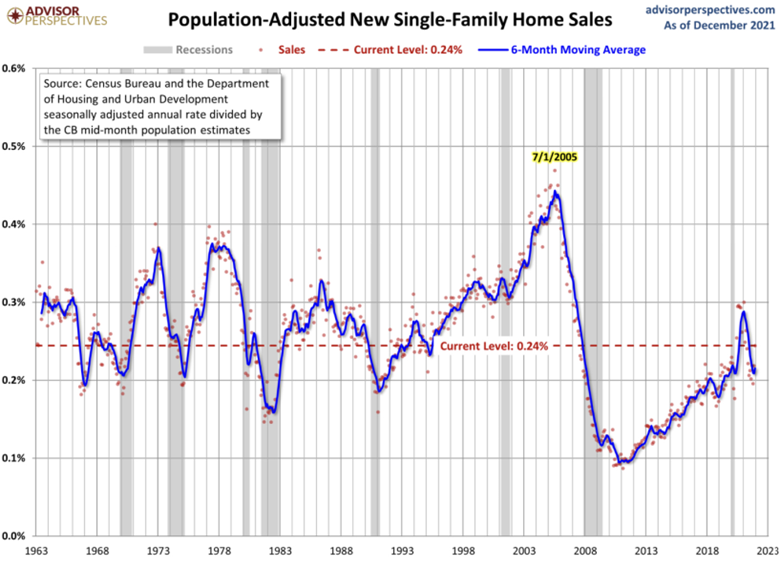

Houses are under-built, and we believe our home builders (DHI, LEN and NVR) have scale and very strong balance sheets to meet the economic need:

Source: Advisor Perspectives.

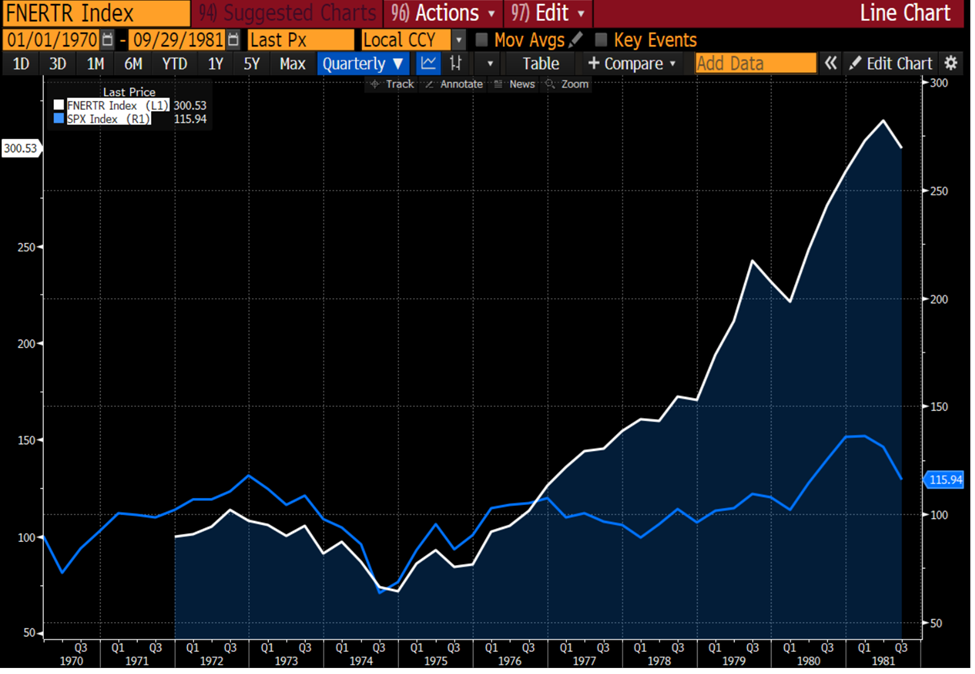

REIT Class “A” malls get inflationary rent expansion via revenue sharing above base minimum rent and were good inflation beneficiaries in the 1970s:

Source: Bloomberg. Data for the time period 1/1/1970 – 9/29/1981.

Therefore, the question for investors is, do you want to squeeze blood out of a “Twilight Zone” turnip in the S&P 500 Index? Do you want to pick for a needle in the haystack among the vast cadre of growth stock investment choices? Or do you want to enjoy the potential sunrise stage in stocks that have historically gained popularity as investors chase “the bird in the hand” in more inflationary times?

Fear stock market failure!

_______________________________________________

The recent growth in the stock market has helped to produce short-term returns for some asset classes that are not typical and may not continue in the future. Margin of safety is the difference between the intrinsic value of a stock and its market price. The price-earnings ratio (P/E Ratio or P/E Multiple) measures a company’s current share price relative to its per-share earnings. Alpha is a measure of performance on a risk-adjusted basis. Beta is a measure of the volatility of a security or a portfolio in comparison to the market. FAANG is an acronym for the market’s five most popular and best-performing tech stocks, namely Facebook, Apple, Amazon, Netflix and Alphabet’s Google. Growth investing is focused on the growth of an investor’s capital. Leverage is using borrowed money to increase the potential return of an investment. Momentum is the rate of acceleration of a security’s price or volume. The earnings yield refers to the earnings per share for the most recent 12-month period divided by the current market price per share. Profit margin is calculated by dividing net profits by net sales. Quality is assessed based on soft (e.g. management credibility) and hard criteria (e.g. balance sheet stability). Value is an investment tactic where stocks are selected which appear to trade for less than their intrinsic values. The dividend yield is the ratio of a company’s annual dividend compared to its share price.

The information contained herein represents the opinion of Smead Capital Management and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Smead Capital Management, Inc.(“SCM”) is an SEC registered investment adviser with its principal place of business in the State of Arizona. SCM and its representatives are in compliance with the current registration and notice filing requirements imposed upon registered investment advisers by those states in which SCM maintains clients. SCM may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Registered investment adviser does not imply a certain level of skill or training.

This newsletter contains general information that is not suitable for everyone. Any information contained in this newsletter represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed in this newsletter will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. SCM cannot assess, verify or guarantee the suitability of any particular investment to any particular situation and the reader of this newsletter bears complete responsibility for its own investment research and should seek the advice of a qualified investment professional that provides individualized advice prior to making any investment decisions. All opinions expressed and information and data provided therein are subject to change without notice. SCM, its officers, directors, employees and/or affiliates, may have positions in, and may, from time-to-time make purchases or sales of the securities discussed or mentioned in the publications.

This Newsletter and others are available at smeadcap.com